Automated bookkeeping means less manual work

Ecommerce accounting automation seamlessly syncs Epic Mens’ orders to QuickBooks, saving the business hours of busywork per week. The extra time and resources gave the business more time to find new vendors and improve marketing activities.

Reduce accounting errors

Optimize tedious processes

Easily expand to new sales channels

Reconcile and close the books in minutes

Accurately capture all orders and transactions in QuickBooks as they happen, not days or weeks later. Automatically post transactions as sales receipts, and easily deposit funds to dedicated clearing accounts.

Neatly match bank deposits

Keep your accountant in the loop

Set yourself up for tax success

Simplify sales tax compliance

Customize how you record sales tax in QuickBooks, and when you post an order, the sales receipt will reflect the correct sales tax rate. You can even customize the list of states where you don’t want to record sales tax.

Organize sales tax by jurisdiction

Validate sales tax collected

Remit sales tax faster

.png?width=200&height=114&name=cs-channies-logo%20(1).png)

FAQs about our accounting features

No, Webgility does not remit sales tax to any particular tax authority. But it can ensure any sales tax you collect routes to the right clearing or undeposited funds in your QuickBooks.

In many cases, you can write off the cost of using Webgility and other necessary work-related business or accounting software subscriptions.

“Unless you have deducted the cost in any earlier year, you can generally deduct the cost of materials and supplies actually consumed and used during the tax year,” according to IRS publication 535.

Generally, any expense you write off should be necessary for running and maintaining the business.

So much!

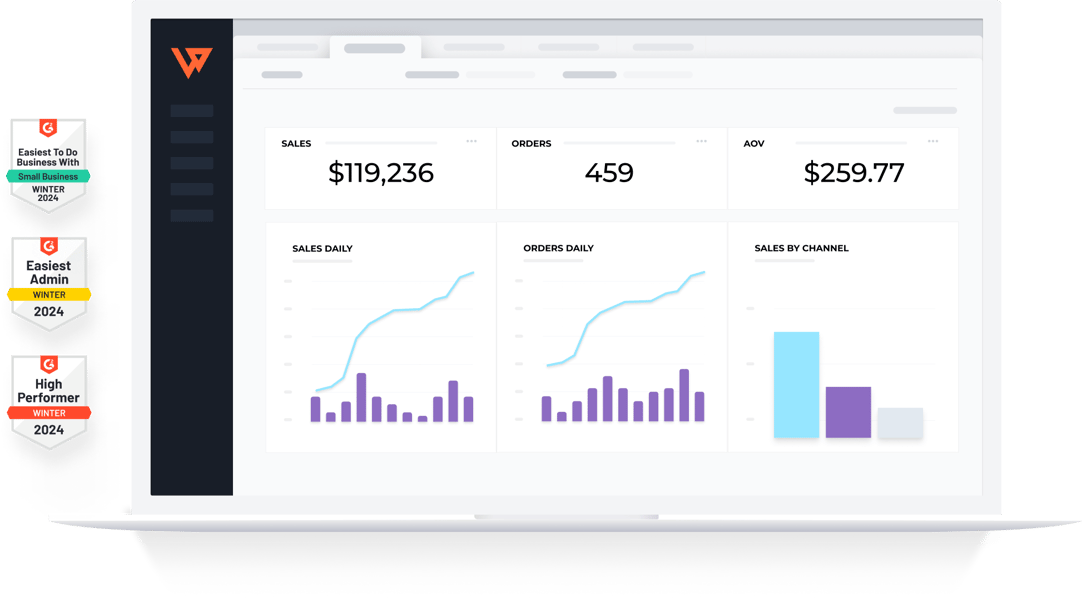

Webgility can help you stay on top of your ecommerce business with a real-time data sync for orders, expenses, prices, fees, and more.

Webgility can help you gain control of your assets with a real-time inventory sync that updates items accounts no matter where you sell — online or in person.

Webgility can help you grow your bottom line with real-time financial reporting of expenses, cash flow, COGS, and more.

Automate accounting and take tedious work off the table