Best Shopify QuickBooks Integration: Top Free Connectors to Try

Contents

Shopify can’t do bookkeeping. It tracks sales, payments, and payouts but doesn’t record transactions in accounting terms.

For proper bookkeeping like tracking COGS, reconciling accounts, managing invoices, or preparing financial statements, you need an accounting software like QuickBooks and a connector that will enable you to integrate it with Shopify.

Many Shopify merchants spend hours on data entry, trying to reconcile sales, fees, and inventory across channels. A Shopify-QuickBooks connector is the game-changer you need.

But how do you find the best Shopify QuickBooks integration tool for your business as there are hundreds of them on the Shopify App Store? This guide breaks it down – helping you evaluate your options, explore five top free/freemium connectors, and follow a simple action plan to get started.

With the right integration, your orders, products, payouts, and multi-channel data sync seamlessly, giving you accurate books and real-time financial visibility.

|

Key takeaways:

|

Why your Shopify store needs QuickBooks integration

Running an online store is exciting until the accounting starts eating up your time. Integrating Shopify with QuickBooks bridges that gap, turning manual financial chores into automated, accurate workflows.

Here’s how it transforms your day-to-day operations:

1. Eliminates hours of manual data entry

The problem- Manually transferring every Shopify sale, refund, and payout into QuickBooks is slow, error-prone, and unscalable. Each transaction requires individual entry, making reconciliation complex and time-consuming, especially with Shopify’s batched payouts. This manual process wastes hours and risks inaccuracies in financial reporting.

The fix- With the right integration, your Shopify orders, fees, and customer records sync automatically into QuickBooks. That means less time buried in spreadsheets and more time growing your business.

2. Reduces accounting errors and discrepancies

The problem- Retyping numbers from Shopify to QuickBooks invites mistakes like typos, missed entries, and mismatched SKUs. Moreover, manual data entry is repetitive and error-prone, leading to inaccurate financials, messy reconciliations, and lost time fixing avoidable bookkeeping errors.

The fix- An automated Shopify-QuickBooks integration minimizes human error by syncing consistent, accurate data between systems. When every sale and adjustment posts correctly, you get cleaner books and stress-free reconciliations.

3. Provides real-time financial visibility

The problem- Data often sits fragmented across different reports and payment processors, making it hard to see true profitability, cash flow, or accurate financials without manual reconciliation. Thus, you don’t get real-time financial visibility in Shopify as this platform focuses on sales operations, not accounting.

The fix- Integrating Shopify with QuickBooks means your sales, refunds, payouts and inventory shifts reflect in your accounting system with minimal delay, giving you a clear, up-to-date view of your cash flow. With that visibility, you can make smarter decisions about pricing, promotions, and stock before things get out of control.

4. Simplifies tax compliance and reporting

The problem- Shopify only collects and displays sales tax. It doesn’t manage how those taxes are recorded, categorized, or reported in accounting terms. With multiple channels, locations, and tax jurisdictions, tracking what’s owed, reconciling payouts, and preparing accurate tax filings becomes complex and error-prone when done manually.

The fix- Ecommerce means lots of moving parts: transaction fees, sales tax by region, refunds, inventory adjustments. When all those flow from Shopify to QuickBooks, it automatically categorizes Shopify sales taxes, maps them to the correct accounts, and generates detailed tax liability and reports. It keeps your tax data accurate and up to date across all channels.

Latest update 2025: Shopify now operates as a marketplace facilitator for Shop App orders, deducting and remitting taxes directly, which can inflate your sales tax liability in QuickBooks if not properly adjusted. Webgility automatically handles these marketplace-collected tax deductions, adjusting your books in real-time to match actual payouts without manual journal entries. Plus, it also removes marketplace tax from the seller's sales tax liability.

5. Multi-channel readiness (if you sell offline or on other marketplaces)

The problem- Shopify only tracks transactions made within its own platform. Sales from retail stores, B2B portals, or marketplaces like Amazon or eBay remain siloed, making it hard to get a unified view of revenue, inventory, and customer data. This fragmentation leads to double data entry, inventory mismatches, and inconsistent financial reporting across channels.

The fix- Some QuickBooks–Shopify connectors connect all your sales channels from Shopify to marketplaces, and retail stores into one centralized accounting system. It automatically syncs orders, inventory, and payments from every source to QuickBooks, ensuring accurate books, real-time visibility, and seamless multi-channel financial management.

What to look for when choosing the best Shopify QuickBooks integration

Finding the right integration is about more than just “connect and go.”

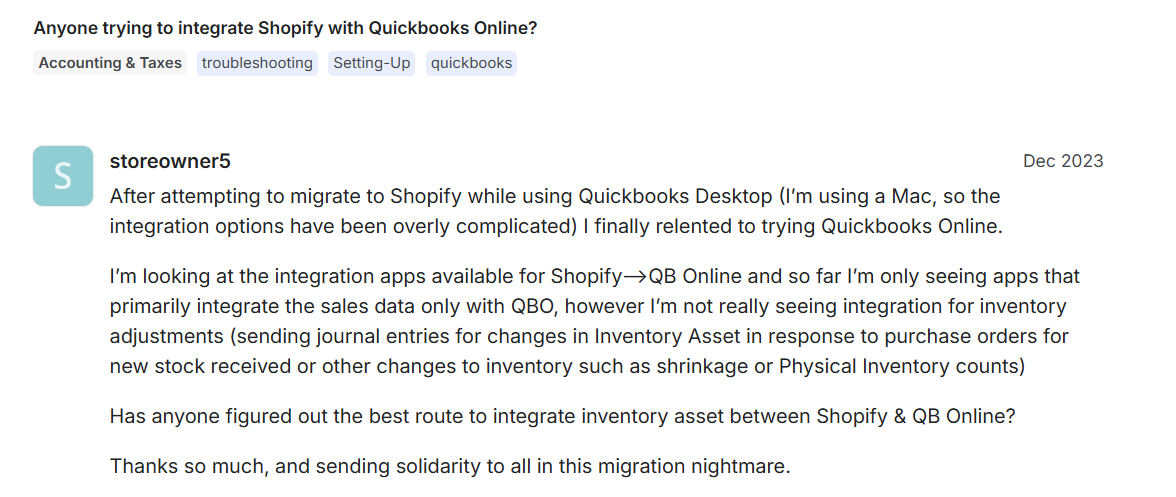

Just look at this Shopify merchant who recently shared their frustration online by not being able to figure out the best Shopify QuickBooks integration tool-

We don’t want you to fall into that same trap. That’s exactly why we’ve curated this guide to help you cut through the noise. But before you make a decision, you must know the key features to evaluate so you can choose a solution that fits your business needs:

1. Compatibility with your version of QuickBooks (Online vs. Desktop)

Not all connectors support every configuration. QuickBooks has multiple editions – Online, Desktop, and Enterprise and each handles data differently. Similarly, Shopify stores vary in features, payment gateways, and app integrations.

Using an incompatible connector can lead to sync errors, missing transactions, or inaccurate data mapping. Ensuring compatibility guarantees smooth automation, accurate financials, and reliable real-time syncing between your store and accounting system.

2. Data sync

What data will move between Shopify and QuickBooks? Good integrations go beyond just sales numbers. They cover inventory, refunds, fees, shipping, discounts, taxes, and more.

If your connector only pulls in orders but leaves out fees or inventory, you’ll still have reconciliation gaps.

Therefore, it is always suggested to choose a connector with real-time, two-way sync that keeps your finances accurate, up to date, and ready for informed decision-making.

3. Sync mode/frequency: Real-time vs scheduled

Real-time sync gives instant visibility into sales, inventory, and cash flow, which is crucial for fast decision-making and accurate reporting. Scheduled syncs, on the other hand, may delay updates and cause temporary discrepancies between Shopify and QuickBooks.

Having said, some apps offer per-order real-time sync; others stick to daily or even manual sync. The Webgility connector, for example, allows you to choose between summary and detailed sync modes.

Choosing the right sync mode ensures your books reflect the latest data and align with your business’s speed and operational needs.

4. Multi-channel support (if needed)

If you sell not only via Shopify, but also through other channels (marketplaces, POS systems), pick an integration that supports multi-channel scenarios. Many tools that integrate with Shopify excel only for that store; others support Amazon, eBay and more.

Not considering this aspect means you’ll end up with fragmented data across systems instead of one unified view.

5. Ease of setup (account mapping and product mapping)

You don’t want an integration that creates extra complexity. Good tools let you map Shopify SKUs to QuickBooks items, set account and product mappings (income, COGS, tax), and define how the sync should behave.

6. Support, reliability, and reviews (especially for accounting accuracy)

An integration is only as good as its accuracy and support. Look at user reviews for issues around fee reconciliation, refunds, and tax handling.

You’ll want a vendor that’s responsive and proven in ecommerce accounting systems like Webgility, known for its white-glove onboarding and exceptional customer support.

Note: Even “free” connectors often have limitations (order volume caps, fewer features) so map them to your growth plans.

Bonus read: Top 10 Reasons Free QuickBooks Connectors Could Be Right for Your Ecommerce Business — and When They’re Not

Top 5 Tools for the Best Shopify QuickBooks Integration

We've dug through the Shopify App Store to find the connectors that offer the best mix of features, reliability, and value. Here are the top five tools to get you started:

1. Webgility QuickBooks Connector

The Webgility QuickBooks Connector bridges the gap between QuickBooks and your ecommerce platforms, automatically downloading order information and posting it to your accounting system. You can set up time intervals for the connector to sync transaction data, checking your online stores at intervals ranging from every 15 minutes to 24 hours.

The connector keeps your books accurate by syncing orders, inventory, and sales data in real-time, with the option to summarize transactions as journal entries or post them individually. It works with both QuickBooks Online and QuickBooks Desktop, making it a versatile solution for businesses using either version of the accounting software.

Key features:

- Detailed, item-level sync: It syncs individual orders, customer details, products, fees, and payouts

- Multi-channel ready: Built to connect not just Shopify but also Amazon, eBay, and more, consolidating them all into QuickBooks

- Bi-directional sync: Can sync inventory levels, product prices, and costs from QuickBooks back to Shopify, acting as a central hub

- Advanced reporting & analytics features. It offers analytics dashboards tailored for ecommerce stores, enabling forecasting, margin insight, and reporting across sales channels

Limitations:

- Free tier has order limits

- Advanced features behind a paywall

Best for: High-volume, multi-channel sellers who require real-time inventory sync, automated accounting, and detailed reporting.

Price: Its flexible (Pay As You Go) pricing scales with your business. It's free for up to 30 orders and goes up to $79 for 1000+ orders.

App Store Ratings: 4.9★ (854 reviews) for Webgility - QBO and Xero Sync

2. QuickBooks Online Global by Intuit

This is the "official" connector built by Intuit, the makers of QuickBooks. It's designed to provide a seamless, native-feeling connection between your Shopify store and your QuickBooks Online account; it does not connect with QuickBooks Desktop.

Key features:

- Track income and expenses and maximize tax deductions for your Shopify business

- Auto-creation of sales receipts/invoices in QuickBooks from Shopify orders

- Sync stock levels, product lists and customer data between Shopify and QuickBooks Online

Limitations:

- Require you to stay within the QuickBooks Online ecosystem

- You may need an upgraded QuickBooks plan to access this app

Best for: Businesses already committed to QuickBooks Online and looking for a built-in, low-cost Shopify integration.

Price: It’s free to install for existing QBO customers. It’s advanced plan goes up to $85 per month.

App Store Ratings: 4.9★ (2789 ratings)

3. Bookkeep QuickBooks + Sales Tax

This Bookkeep app automates the connection between your Shopify store (and other channels) and your accounting system like QuickBooks. It’s focused on accounting automation: daily journal entries, payout reconciliation, and sales tax workflows for Shopify stores.

Key features:

- Automate Shopify sales, fees, taxes, and payouts into accrual-based journal entries in QuickBooks

- Reconcile complex marketplace/channel payouts and tax compliance

- Recognize revenue by Order Date or Ship Date, customized for all your stores

Limitations:

- More focused on bookkeeping automation (sales/fees/taxes) rather than full product/inventory sync

- Not ideal if you want real-time, per-order detail or bi-directional inventory sync

Best for: Merchants wanting to automate complex sales tax and fee management without deep integration into product or inventory details

Price: It has a free trial and its paid plans are based on your store's annual revenue, not order volume. Plans start around $19/month for stores under $200k in annual revenue and go up to $199 per month.

App Store Ratings: 5★ (44 reviews)

4. SyncTools for QuickBooks Xero

Launched in 2024, SyncTools is a dedicated, purpose-built connector that focuses on one thing: making the Shopify-to-QuickBooks link simple and accurate. It provides a streamlined experience aimed at syncing orders, fees, and inventory data.

Key features:

- Keep inventory accurate with real product costs and COGS tracking

- Track deferred revenue for unfulfilled orders and auto-recognize once fulfilled

- Organize sales by country, product type, or sales channel for insights

Limitations:

The free plan is limited to manual syncing. Auto-sync and multi-currency support are reserved for paid plans

It lacks full multi-channel capability or advanced inventory rules compared to enterprise tools

Best for: Small merchants who just need a straightforward connector between one Shopify store and QuickBooks without heavy multi-store complexity.

Price: Free for up to 200 orders per month, with the highest plan at $59 per month for up to 2,000 orders.

App Store Ratings: 5★ (4 reviews)

5. QuickBooks Bridge by Parex

QuickBooks Bridge is a Shopify app designed to automate the transfer of sales, orders, customers, products and related financial data from your Shopify store into QuickBooks Online. It captures detailed order‐level data and creates journals or grouped entries to ease reconciliation.

Key features:

- Choose to have automatic sync scheduled (e.g., daily) or run manual syncs when preferred

- Supports syncing Shopify payouts, fees and mapping them into QuickBooks, assisting with reconciliation of what you actually receive

- Scalable pricing that accommodates low to high‐volume stores

Limitations:

- Setup may be more involved than plug-and-play connectors

- Free tiers often limit order volume, with paid plans unlocking full features

Best for: Merchants with multiple stores/channels who need a unified bookkeeping pipeline into QuickBooks but don’t want the highest tier enterprise cost.

Price: This app offers a free plan to install and test, with paid plans that are extremely competitive. Its QBO plans start at $10/month for 100 orders, and go up to $30/month for 2000 orders per month.

App Store Ratings: 4.9★ (152 reviews)

How to get started with your Shopify-QuickBooks integration

Setting up an integration is a step-by-step process. Follow these steps to ensure a smooth, accurate, and hassle-free launch:

1. Choose the connector

Use your audit from Step 1 to make a decision. Refer back to our "What to Look For" criteria and the "Top 5" list.

- If you're a high volume, multi-channel seller on QBO or QBD who wants to scale, your main option is Webgility QuickBooks Connector

- If you're on QBO with low volume, the SyncTools or QuickBooks Bridge free/low-cost plans are a perfect start

- If your accountant is in charge and loves clean books, show them Bookkeep

- If you're already on QBO and want the simplest, "official" path, start with the free Intuit connector

2. Install and authorize the connector

Once you’ve picked up the tool, install it via the Shopify App Store (or vendor site) and connect it to your QuickBooks account. During the setup, you’ll typically grant permissions, then map key data: customers, products/SKUs, income/expense accounts. For QuickBooks Desktop especially, you may need to generate a desktop token and complete mapping before you go live.

3. Configure sync settings

Fine-tune what’s synced (orders, payouts, products, inventory, customers, fees, taxes) and how often it happens: in real-time, scheduled daily, or manually as needed. Set up detailed product/account mapping so Shopify SKUs line up correctly with QuickBooks items, and review tax/currency settings for compliance.

4. Test with a handful of orders

Do not sync your entire 6-month order history on day one. Run a test. Go into your new app and manually push one or two recent orders. Then, log in to your QuickBooks account and play detective:

- Did the sale show up?

- Is it in the right income account?

- Did it record the sales tax in the right liability account?

- Did it pull out the processing fee and put it in the right expense account?

- Is the final deposit amount correct?

If it looks perfect, you're ready to go. If not, go back to Step 3 and fix your mapping

| 💡Pro tip: Always back up your QuickBooks data and double-check tax and account mappings before going live. Using a platform like Webgility will give you the advantage of their white-glove onboarding. Their experts can help verify everything before your first sync. |

Ready to streamline your finances? Here's your 3-step action plan!

You’ve seen how powerful the right Shopify–QuickBooks integration can be for growing ecommerce owners and multi-channel merchants.

The key message is simple: automating your Shopify to QuickBooks sync is a critical step for saving time, ensuring accuracy, and unlocking real financial clarity for growth.

Explore how Webgility helped Vector Business Solutions in reducing manual efforts by 90% and recording Shopify sales throughout each month.

It’s time to get started! Here’s a simple plan to get this done:

- Pick one of the top five connectors – Webgility QuickBooks Connector, SyncTools for Quickbooks, QuickBooks Online Global, Bookkeep QuickBooks, or QuickBooks Bridge

- Evaluate using the key criteria by ensuring compatibility with your QuickBooks edition, sync scope, ease of setup and whether the free tier or pricing fits your growth plans

- Set up your Shopify QuickBooks integration now to save time and be ready for growth with automated accounting workflows.

Book a personalized demo to dive deeper into how Webgility can support your ecommerce accounting with extensive Shopify and QuickBooks sync capabilities. Happy growing!

FAQs

Does Shopify have a QuickBooks integration? If yes, how do I link both tools?

Yes. You can connect Shopify with QuickBooks using apps like Webgility or QuickBooks Online Global. Install the apps, link both accounts, map your data (orders, fees, inventory), and run a test sync to ensure everything records accurately.

Can Shopify do bookkeeping?

Shopify itself doesn’t perform traditional bookkeeping but provides the sales, inventory, and transaction data that accounting software needs for bookkeeping.

How do I import products from QuickBooks to Shopify?

Use an integration tool like Webgility to enable bi-directional inventory sync. It lets you import QuickBooks products into Shopify, align SKUs, and update prices or stock automatically.

Yvette Zhou is a Group Product Manager at Webgility, passionate about SaaS, fintech, and ecommerce innovation and product development.

.png?width=56&height=56&name=image%20(3).png) Yvette Zhou

Yvette Zhou