Xero Clover Integration Guide for 2025

Contents

TLDR

Why connect Clover POS with Xero in 2025?

Manually entering Clover sales into Xero at the end of each day? It's exhausting just to think about it. One Reddit user in r/Bookkeeping described spending 16 hours a week on manual accounting tasks. That's nearly two full workdays you could spend on literally anything else.

Bookkeepers on Reddit share how much time they spend on manual data entry

When you automate the connection between Clover and Xero, those hours disappear. Your sales data flows in automatically. Refunds post correctly. Fees get categorized. And your books reflect what happened yesterday, not three weeks ago.

But here's the thing: not all integrations actually deliver on that promise.

Some sync once a day (too slow). Others miss important details like processing fees or split payments. And most can't handle the complexity when you start selling online in addition to your POS.

We built Webgility specifically to solve these problems for retailers who need more than basic syncing. Real-time updates, multi-channel support, and AI that catches errors before they mess up your books. Let’s take a closer look.

What is Clover Xero integration?

Your Clover POS records every sale, refund, and transaction. Xero needs that information formatted in a specific way to create proper journal entries and financial reports. Integration software handles the translation automatically.

Here's how it works in practice:

A customer buys something at your store. Clover records the sale, including the amount, payment method, taxes, and any tips. Your integration software grabs that data and pushes it into Xero in the correct format. Xero creates the accounting entries, updates your revenue accounts, and tracks the tax you collect.

No manual entry. No copy-pasting. It just happens.

To raise a scenario, suppose you run a coffee shop. Someone orders a latte and pays with their card. Clover processes the payment. By the time you finish making their drink, that transaction is already in Xero. Your accountant can see today's revenue in real time, not next week when you finally get around to uploading CSV files.

The integration handles all the technical stuff (API calls, data formatting, error handling). You just see accurate numbers in Xero.

Key benefits of Clover Xero integration

Here are the major benefits of Clover Xero integration:

Your reconciliation matches

No more "where did that $50 go?" moments when your bank statement doesn't line up with your books. Every transaction logs once. Just once. When you reconcile bank deposits against Xero records, the numbers match on the first try.

We hear from retailers all the time who spent 5-10 hours monthly on reconciliation before automating. Reviews on G2 for accounting automation tools consistently mention time savings as the top benefit.

Taxes don't require detective work

Sales tax flows directly from Clover into the correct Xero liability accounts. When tax season arrives, you have clean records that show exactly what you collected and when.

No spreadsheets. No guessing. Just accurate data that your accountant can actually work with.

You can see your cash position right now

Want to know if you can afford that inventory reorder today? Check Xero. With real-time (or near real-time) syncing, your financial reports reflect yesterday's activity, not last month's. You can make decisions based on current data instead of outdated snapshots.

Inventory tracking (sort of)

Basic integrations sync sales quantities so you know what's moving. This helps, but it's not perfect. Native Clover Xero integration doesn't give you robust multi-location inventory management or real-time stock updates across different sales channels.

That limitation becomes obvious when you start selling online in addition to your physical store. Your POS inventory and ecommerce inventory exist in separate worlds, and the basic integration can't unify them.

This is exactly why we built Webgility with multi-channel support. It extends beyond basic sales syncing to include AI-powered reconciliation, real-time inventory updates across all channels, and the kind of detailed financial tracking that growing retailers need.

How to integrate Clover with Xero

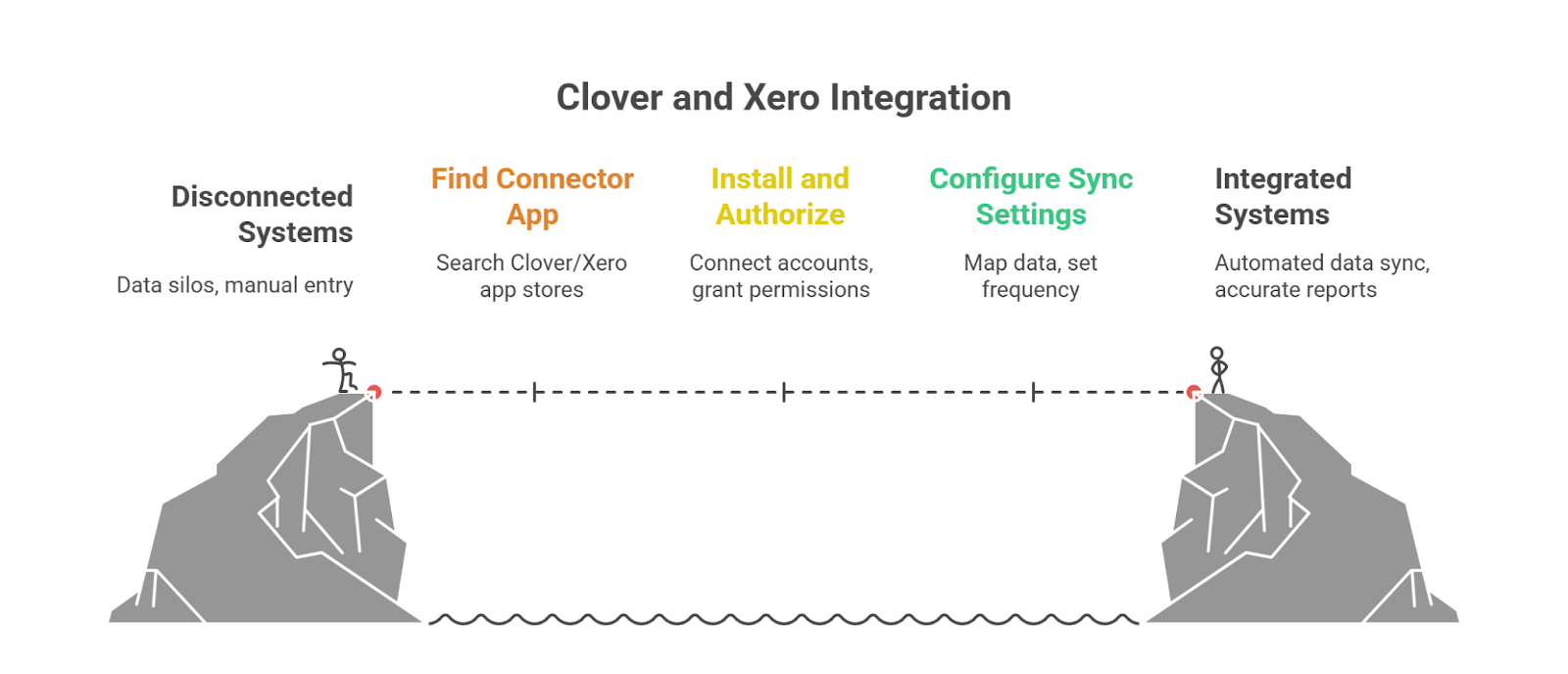

The 4-step process for integrating Clover and Xero to achieve automated data sync

The 4-step process for integrating Clover and Xero to achieve automated data sync

Setting up the direct integration is pretty straightforward if you're comfortable clicking through app marketplaces.

Step 1: Find the integration app

Go to the Clover App Market and search for Xero. You'll find a few different connector apps. Alternatively, search for Clover in the Xero App Store.

Pick one that has decent reviews and does what you need.

Step 2: Install and authorize

Click "Install" or "Connect." You'll log into both Clover and Xero to authorize the connection. This lets the integration access your data from both systems.

Step 3: Configure your sync settings

This part matters. You need to decide:

- What data syncs (sales, refunds, fees, taxes, tips)

- How often it syncs (daily, hourly, real-time if available)

- Where transactions land in Xero (which accounts for revenue, fees, and tax liability)

Get the account mapping right. If you map tips to "Other Income" instead of "Tip Revenue," your reports will look weird, and you'll spend time fixing it later.

Step 4: Run test transactions

Process a few sales in Clover. Wait for the sync. Check Xero to make sure everything appears correctly. Verify amounts, dates, and account assignments.

Better to catch problems now with test data than discover them after three months of live transactions.

Step 5: Monitor for the first few weeks

Keep an eye on your Xero data. Make sure nothing's duplicating or disappearing. Adjust your account mapping if needed.

Also, watch out for these issues:

- Historical data can cause duplicates. If you already manually entered some sales, don't sync them again from Clover.

- Timezone settings matter. If Clover thinks it's Tuesday and Xero thinks it's Wednesday, your transactions will appear on the wrong dates in your reports.

- Account mapping errors are common. Double-check where everything's landing before you process hundreds of real transactions.

Common challenges with a direct Clover Xero integration

The native integration works fine for simple setups. One store, one POS terminal, no online sales. But that's not most retailers these days.

You can only sync POS data

Clover is a POS system. Period. If you also sell through Shopify, WooCommerce or Amazon, the direct integration won't touch those sales. You need separate integrations for each channel, which means managing multiple data streams and reconciling them manually in Xero.

Weighing the pros and cons of integration

Syncing happens in batches, not real-time

Most direct integrations sync once or twice daily. Your morning sales might not hit Xero until evening. If you're checking cash flow or making purchasing decisions during the day, you're working with incomplete information.

You don't get detailed payout breakdowns

Basic transaction syncing gives you date, amount, and payment method. But what about the detailed breakdown of processing fees? What about separating gross sales from net deposits? Native integrations often lack this level of detail, which makes reconciliation harder when your bank deposit doesn't match your gross sales.

Edge cases require manual fixes

Refunds, partial payments, split transactions, and voided sales. These exceptions often sync incorrectly or not at all. You end up reviewing them manually anyway, which defeats the purpose of automation.

However, Webgility solves these specific problems. We designed it for retailers who operate across multiple channels and need real-time accuracy without constant manual oversight.

Webgility as an advanced Clover Xero integration solution

If you're selling through Clover and planning to add online sales (or already have), you need integration that scales beyond basic POS syncing.

We built Webgility to unify all your sales channels into one automated workflow. Here's what makes it different:

Real-time sync

Not batch processing. Not end-of-day dumps. Real-time.

When a sale happens on Clover or Shopify, or Amazon, it flows into Xero within minutes. Full transaction detail, including fees, taxes, and discounts. Your financial data stays current throughout the day, not just after you close.

AI catches errors before they become problems

Webgility's AI actively monitors your transactions and flags anomalies. Missing payout? Fee mismatch? Inventory discrepancy? You get alerted immediately instead of discovering issues during month-end reconciliation.

Also, this reduces manual reconciliation time by about 90% compared to native integrations.

Multi-channel works out of the box

Sell on Clover, Shopify, WooCommerce, BigCommerce, Amazon, eBay, Walmart, and more? Webgility syncs all of them into Xero using the same standardized format. One integration. One reconciliation process. No more juggling five different data exports.

You get the actual transaction details

Not just "Sale: $127.50" but the complete breakdown: gross sales, marketplace fees, processing fees, tax collected, net deposit. Everything is separated and categorized correctly, so your reports actually make sense.

Choose between a summary posting (one daily journal entry) or a detailed posting (every transaction itemized). Either way, your books stay audit-ready.

We handle the setup for you

White-glove onboarding means our team configures everything, tests it thoroughly, and trains your staff. After launch, you get unlimited support. No ticket limits. No "premium support" upsells. Just help when you need it.

Webgility's Onboarding Process Explained

Choosing the right Clover Xero integration in 2025

Not sure which solution fits your business? Here's how to evaluate your options.

Does it sync in real-time?

If you need current financial data throughout the day (not just after closing), real-time sync matters. Batch processing that runs once or twice daily might be fine for some businesses, but it creates delays when you're making time-sensitive decisions.

Can it handle multiple sales channels?

Selling only through Clover POS? The native integration probably works fine. But if you're already online (or thinking about it), choose an integration that consolidates all your channels instead of requiring separate setups for each.

Will it scale with your order volume?

Can the integration handle 100 daily transactions? 1,000? 10,000? Make sure it won't slow down or break when your business grows. The last thing you need is an integration that worked great at 50 orders per day but falls apart at 500.

What happens when something breaks?

Look at the support structure. Email-only support with 48-hour response times? Or access to a dedicated team that actually knows your setup and can troubleshoot immediately?

We've heard too many stories from retailers who switched to Webgility after getting stuck with "submit a ticket and wait" support from other providers.

Does it just move data, or does it actively help?

Basic integrations transfer information from point A to point B. That's it. Advanced tools use AI to catch errors, optimize workflows, and maintain clean books automatically. The difference shows up in your reconciliation time and error rates.

Here’s our take: for basic retail with a single Clover terminal and no online presence, the direct Clover Xero integration handles the essentials.

But for growing multi-channel retailers who need accuracy, speed, and scalability, Webgility is the most comprehensive option. It's built specifically for businesses that are serious about their financials and don't want to outgrow their tools in six months.

Final Note

Connecting Clover with Xero eliminates hours of manual work and gives you accurate, current financial reports. For straightforward retail operations, direct integration does the job.

But here's what we see constantly: retailers don't stay simple. You add an online store. You open another location. You start selling on marketplaces. Suddenly, the basic integration isn't enough.

That's exactly when advanced solutions like Webgility become essential. Real-time sync, AI-powered accuracy, multi-channel coverage, and actual expert support mean your accounting scales with your business instead of holding it back.

Webgility helps retailers automate the tedious parts of accounting so they can focus on growth. If you're spending hours on reconciliation or worried about expanding because your accounting can't keep up, schedule a demo and see the improvement.

FAQs

Does Clover integrate directly with Xero?

Yes. You can connect Clover with Xero through apps in the Clover App Market or Xero App Store. These native integrations sync sales, refunds, and basic transaction data from your Clover POS into Xero.

However, they're limited to POS data only and don't support advanced features. If you're selling across multiple channels or need more than basic transaction transfer, you'll want to look at more robust solutions like Webgility.

Can Clover Xero integration handle refunds and taxes automatically?

Yes, most integrations sync refunds and taxes automatically. When you process a refund in Clover, it appears as a negative entry or credit in Xero. Sales tax collected at the register flows into your designated tax liability accounts.

The key is verifying your account mapping during setup. If refunds or taxes land in the wrong Xero accounts, your reports won't be accurate.

How often does Clover sync with Xero?

Depends entirely on which integration you're using. The native Clover Xero integration typically syncs once or twice per day in batch mode. That means transactions might not appear in Xero until hours after they occur. Solutions like Webgility offer real-time or near-real-time syncing, with transactions appearing in Xero within minutes.

What if I sell online and in-store – will this integration support both?

The direct Clover Xero integration only handles Clover POS transactions. It won't sync sales from Shopify, WooCommerce, Amazon, or any other ecommerce platform.

If you sell across multiple channels, you'll need either separate integrations for each platform (which means managing multiple data streams and reconciling them manually) or a unified solution like Webgility that consolidates all your sales channels into Xero through a single integration.

How does Webgility improve on Clover's native integration?

Webgility offers real-time syncing, replacing batch processing, and AI-powered reconciliation that automatically identifies errors before they escalate.

It also provides multi-channel support, allowing all sales (POS and online) to flow into Xero together using standardized formatting. Additionally, it offers detailed transaction breakdowns, including fees and payouts, separated correctly, and includes white-glove onboarding with unlimited ongoing support.

David Seth is an Accountant Consultant at Webgility. He is passionate about empowering business owners through his accounting and QuickBooks Online expertise. His vision to transform accountants and bookkeepers into Holistic Accountants continues to grow.