.png)

Should You Track This as a Prepaid Expense? Your QuickBooks Decision Guide

Contents

TLDR

Recording prepaid expenses in QuickBooks seems straightforward until your ecommerce business scales.

Soon, you are tracking Shopify subscriptions, Amazon storage fees, annual software licenses, and advertising retainers that all renew on different schedules.

One miscategorized prepayment distorts your profit and loss statement for months, making your margins look inflated in January and inexplicably low by summer.

Manual amortization schedules break down as complexity grows.

This guide shows you how to handle prepaid expenses correctly, avoid costly mistakes, and know when automation becomes essential.

The prepaid expense challenge for multi-channel QuickBooks users

A common scenario: You pay $12,000 upfront for annual insurance coverage in January. By default, QuickBooks records this as a single expense, which inflates your January profit and loss by $11,000 and leaves February through December understated.

This misclassification distorts your financials and makes it difficult to see true monthly performance.

Other Current Assets option in QuickBooks

In QuickBooks, prepaid expenses should be classified as Other Current Assets rather than immediate expenses. This approach spreads costs across the periods that benefit from the payment, giving you accurate monthly financials and supporting better decision-making.

For ecommerce businesses selling across multiple channels, the complexity increases. Each platform comes with its own subscriptions, storage fees, and software licenses. Managing these manually means tracking:

- Annual ecommerce platform subscriptions (Shopify Plus, BigCommerce)

- Quarterly marketplace storage fees (Amazon FBA, Walmart Fulfillment)

- Multi-year software licenses (inventory, analytics tools)

- Annual insurance policies (liability, product, cyber)

- Prepaid shipping contracts with major carriers

Each prepaid expense requires its own allocation schedule. Missing even one creates reconciliation gaps that compound over time. As you add more channels, manual tracking becomes unsustainable.

Suggested read: Maximizing Efficiency in QuickBooks Enterprise for Ecommerce

How prepaid expense errors compound across channels

A single misclassified $10,000 software license can inflate your January expenses by 1,100 percent compared to proper monthly allocation. This error has three major consequences:

1. Revenue timing mismatches destroy decision-making

When an annual $6,000 Shopify subscription is expensed entirely in January instead of allocated at $500 per month, January appears unprofitable. This can trigger unnecessary budget cuts or mask operational issues in later months, leading to poor business decisions.

Suggested read: QuickBooks Online vs. Desktop: Which Is Best for You?

2. Tax calculation errors cost real money

Expensing $15,000 in annual insurance upfront can shift thousands of dollars between tax years. For businesses near income thresholds or operating in multiple states, this can result in:

- Unexpected tax liabilities from understated current-year income

- Missed deduction opportunities in future periods

- Increased risk of IRS scrutiny due to inconsistent expense timing

Suggested read: How to Manage Business Expenses Effectively for Taxes

3. Multi-channel reconciliation becomes impossible

Each missed allocation creates a gap. After six months, a business tracking five prepaid expenses incorrectly across three channels faces 30 individual discrepancies. Unwinding these requires:

- Reconstructing transaction history across platforms

- Recalculating allocations for each expense

- Posting correcting journal entries across multiple periods

Common compounding errors for multi-channel sellers:

- Amazon storage fees hitting the wrong months

- Shopify annual plans expensed upfront

- Software licenses allocated incorrectly

- Insurance premiums mismatched to coverage periods

Ecommerce automation tools like Webgility reduce these errors by syncing marketplace fees and subscriptions directly to QuickBooks, ensuring consistent period allocations without manual intervention.

To avoid these pitfalls, you need a clear framework for deciding when to track payments as prepaid expenses.

Decision framework: When to track payments as prepaid expenses in QuickBooks

If a payment exceeds $1,000 or covers more than three months, track it as a prepaid expense. This rule eliminates guesswork and prevents immaterial items from creating unnecessary work.

Prepaid expense decision checklist

- Amount threshold: Does the payment exceed $1,000?

- Yes → Track as prepaid expense

- No → Continue to next check

- Duration threshold: Does it cover more than three months?

- Yes → Track as prepaid expense

- No → Continue to next check

- Complexity multiplier: Are you managing three or more channels with recurring fees?

- Yes → Track marketplace fees over $500 annually as prepaid

- No → Expense directly if under both thresholds

Ecommerce-specific examples:

- Shopify Plus annual subscription ($2,000): Meets amount threshold → Prepaid expense, allocate $167 per month

- Amazon FBA quarterly storage fee ($1,200): Meets amount threshold and covers three months → Prepaid expense, allocate $400 per month

- Wholesale inventory software license (multi-year, $3,600): Meets both thresholds → Prepaid expense, allocate based on contract period

When B2B workflow automation becomes essential: If you manage three or more channels, five or more recurring prepaids, or 100+ orders per month, Webgility ensures reliable tracking and allocation.

Once you know a payment should be tracked as prepaid, here is how to record it in QuickBooks.

Suggested read: QuickBooks Desktop Integrations to Watch Out For

How to record prepaid expenses in QuickBooks: Step-by-step

Recording prepaid expenses in QuickBooks involves three main steps

Step #1: Set up a prepaid expense account

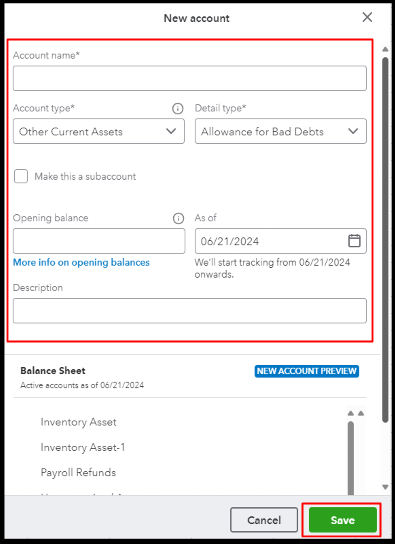

In your Chart of Accounts, create a new account under "Other Current Assets" labeled "Prepaid Expenses".

Step #2: Enter the payment

When you pay the vendor, record the transaction as a debit to "Prepaid Expenses" and a credit to "Cash" or "Bank".

- In QuickBooks Online: Use the "Journal Entry" feature to post the transaction

- In QuickBooks Desktop: Tap "Make General Journal Entries" to record the payment

Step #3: Create recurring journal entries

Each month, move the appropriate portion from "Prepaid Expenses" to the relevant expense account (e.g., Insurance Expense, Software Expense).

Then, set up recurring transactions in QuickBooks to automate this allocation.

Webgility automates this process, posting and allocating prepaid expenses across channels without repetitive journal entries.

Beyond recording, staying organized and audit-ready is key.

Suggested read: How to Automate Bookkeeping for Ecommerce

Building an audit-ready prepaid expense system

Audit-ready prepaid expense management means keeping documentation, reviewing allocations monthly, and using real-time visibility tools.

Documentation to keep:

- Vendor invoices and contracts

- Payment confirmations and receipts

- Allocation schedules and journal entry records

Best practices:

- Review prepaid expense allocations monthly to ensure accuracy

- Store all supporting documents in a centralized, accessible location

- Use real-time visibility tools to monitor balances and spot discrepancies early

Platforms like Webgility provide always-updated prepaid expense balances, reducing surprises and enabling faster month-end close. Even the best manual systems reach a breaking point. Here is when and how to automate.

The automation threshold: When manual tracking breaks down

If you manage three or more channels, five or more recurring prepaids, or 100+ orders per month, automation is no longer optional. Manual tracking becomes a bottleneck, increasing the risk of errors and missed allocations.

Webgility ecommerce accounting automates prepaid expense management across your entire ecommerce operation. The platform syncs, allocates, and reconciles accounts and prepaid expenses across channels and accounting periods without manual journal entries.

When you prepay for Amazon FBA storage, annual Shopify subscriptions, or quarterly advertising retainers, Webgility captures these expenses and posts them to QuickBooks with the correct amortization schedule automatically.

Businesses using Webgility save up to 90% of time on reconciliation and month-end close.

PartyMachines, an ecommerce seller managing multiple channels, was spending 2 to 3 weeks monthly entering data into QuickBooks and manually tracking prepaid allocations.

After implementing Webgility, the founder recovered 8 to 16 hours weekly and gained the ability to measure channel-specific and SKU-level performance accurately.

The question is not whether to automate, but when the cost of manual errors and lost time exceeds the value of keeping your current process.

Sign up for a free Webgility trial today.

Frequently asked questions (FAQs)

How do I know if a payment should be tracked as a prepaid expense in QuickBooks?

If the payment is over $1,000 or covers more than three months, it should be tracked as a prepaid expense. This ensures accurate allocation and financial reporting.

What documents should I keep for prepaid expenses?

Maintain vendor invoices, contracts, payment receipts, and allocation schedules. These support your allocations during audits and help ensure compliance.

Can QuickBooks automate prepaid expense allocations for multiple channels?

QuickBooks supports recurring transactions, but as your business grows, automation tools like Webgility can sync and allocate prepaid expenses across channels more efficiently.

What is the benefit of allocating prepaid expenses monthly?

Monthly allocation matches expenses to the periods they benefit, resulting in more accurate profit and loss statements and tax calculations.

David Seth is an Accountant Consultant at Webgility. He is passionate about empowering business owners through his accounting and QuickBooks Online expertise. His vision to transform accountants and bookkeepers into Holistic Accountants continues to grow.