Top Global Ecommerce Statistics for Retailers and Brands

Contents

Engaging in global ecommerce, also known as cross-border or international ecommerce, is a lucrative strategy for many established retailers and brands. Broadening your business presence has many advantages, including a larger customer base, amplified brand awareness, and easier expansion into foreign markets. What’s more, global ecommerce has provided a viable solution for retailers and brands weathering pandemic twists and turns. Indeed, going global has boosted ecommerce sales, uncovered new markets, and spurred long-lasting consumer trends.

But let’s break this down by the numbers: Here’s what retailers and brands need to know.

What Global Ecommerce Looks Like Now

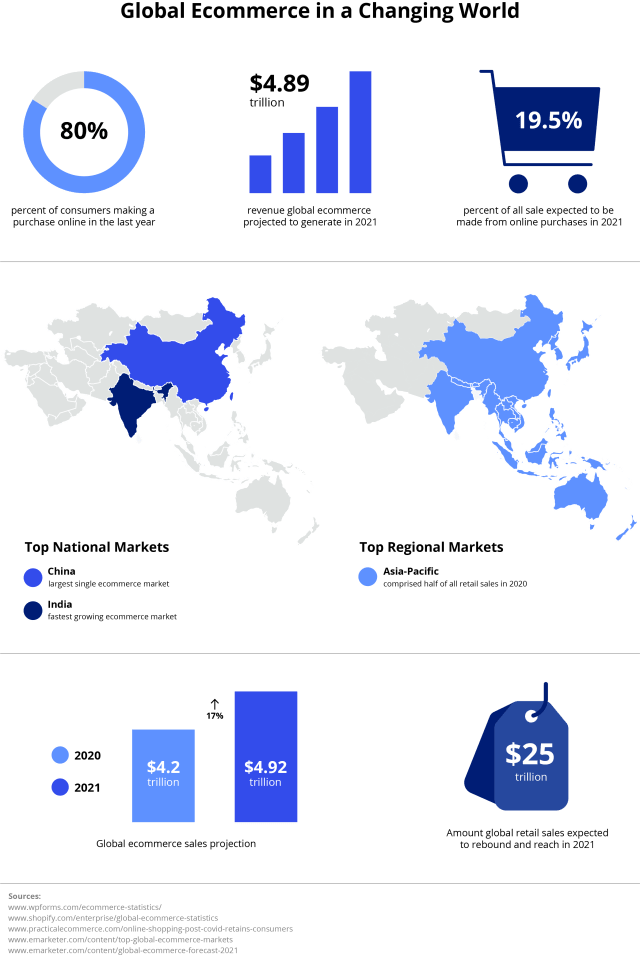

To start, it would be insufficient to speak of the global ecommerce landscape without considering how worldwide digital connectivity has enabled the marketplace to thrive. Per Statista, 48% of people globally own a smartphone, and 60% have regular Internet access. That access has empowered 80% of consumers to make a purchase online in the last year from an estimated 12-24 million ecommerce businesses.

The result? Global ecommerce is—and remains—a massive opportunity for both burgeoning and established businesses. Consider:

- The global ecommerce market is projected to generate $4.89 trillion in 2021. (Source)

- Global ecommerce sales in 2021 will outpace research firm eMarketer’s pre-pandemic predictions by more than $147 billion. (Source)

- 19.5% of all sales are expected to be made from online purchases in 2021, a 45.8% increase in ecommerce market share over two years. (Source)

- Growth projections show online sales reaching 21.8% of total retail sales by 2024.

- Around 76% of U.S. adults shopped online at some point. 62% of them regularly shop online. (Source)

- Desktop orders made up only 27% of traffic and 39% of orders in 2021. At the same time, mobile orders made up 58% of orders and 71% of traffic to e-commerce sites. (Source)

The Top Global Ecommerce Markets

The calamity that was 2020 fueled rapid acceleration of online buying in several countries that had been lagging before the pandemic. In fact, Shopify found that 10 years of ecommerce growth happened in just 90 days during the pandemic. The outcome? Asia-Pacific, China, and India are the new ecommerce markets to watch.

- Asia-Pacific

- North America

- Europe

The Top National Markets

- China

- United States

- United Kingdom

Furthermore, consider the following stats from eMarketer:

Asia-Pacific

- Digital sales are projected to hit nearly $3 trillion in 2021.

- Ecommerce revenue will hit more than 3x the sales of North America (and 5x sales in Western Europe)

- Asia-Pacific is the top regional market for ecommerce sales, followed distantly by North America.

China

- China is the top national ecommerce market by a large margin and will not likely be overtaken in the foreseeable future.

- 52% of total online retail sales are attributed to Chinese customers, far outpacing the 19% attributed to customers in the U.S.

India

- Experts predict that nationally, the most rapidly growing ecommerce market between 2021 and 2025 will be in India.

- There, digital sales are projected to jump 27% in 2021.

- By 2022, India will rank 8th in annual ecommerce sales.

Global Ecommerce in a Post-Pandemic World

Research from the Mastercard Economics Institute found ecommerce in the U.S. only comprised 11% of total retail sales before the pandemic, but it reached a peak of 22% in 2020. Closures of nonessential businesses drove consumers online, where they bought everything from groceries to household necessities to social distancing approved activities. But what happened as the world reopened? Many shoppers have continued buying from online businesses, and ecommerce is now a 17% piece of the pie. Europe showed similar findings at 8%, 12%, and 9%.

Here’s what else is happening in the post-pandemic global ecommerce market:

- Intelligence firm eMarketer predicts that total retail sales will rebound to pre-pandemic levels and reach $25 trillion in 2021.

- After surging 25% in 2020, to $4.2 trillion, ecommerce sales worldwide are projected to climb another 16.8%, to $4.92 trillion.

- Every market tracked by experts saw double-digit ecommerce growth. Notably, Latin America grew 36.7%, Argentina grew 79%, and Singapore grew 71%.

Looking Ahead to the Future of Global Ecommerce

It’s no secret that ecommerce has been forever changed, but think tank Practical Ecommerce has identified a few trends that will direct the course of its future.

- Shoppers will slowly return to brick-and-mortar stores. Foot traffic is currently only 18.7% lower than pre-pandemic volumes.

- Curbside pickup will continue to be offered by grocery and non-grocery physical stores.

- Consumer spending will shift away from physical goods and toward experiences like travel, movies, and live entertainment.

- 68% of consumers now expect delivery within three days, so online sellers will meet their demands.

As ecommerce becomes even more widespread, retailers and brands should be prepared to go global if they haven’t already. The data clearly shows rapid ecommerce growth around the world, meaning there’s a major opportunity to cash in on this surging sector of retail.

By guest contributor Taylor Knauf

The Webgility Team

The Webgility Team