How to Solve 5 Common Xero Reporting Bottlenecks with Automation

Contents

TLDR

You open Xero expecting clarity. Instead, your profit and loss statement shows numbers that make no sense. Revenue looks inflated because Amazon fees are not breaking out correctly. Your best-selling product shows negative margins, but you know that cannot be right.

Inventory reports claim you have 47 units in stock, but your warehouse says 52. You need to make a purchasing decision today, but the data is from last week.

In this guide, you will learn how to solve the five most damaging Xero reporting bottlenecks with automation. See how real-time connectors like Webgility make financial clarity possible for ecommerce.

The real Xero reporting bottlenecks for ecommerce businesses

Manual Xero reporting cannot keep up with the complexity of multichannel ecommerce accounting.

Ecommerce teams face unique challenges: multiple sales channels on different schedules, variable marketplace fees, and inventory that moves faster than accounting records can track. These factors create five specific bottlenecks:

- Month-end close delays: Orders from multiple channels require manual entry, fee allocation, and payout matching before books can close

- Multi-entity and multichannel consolidation: Each platform exports data differently, forcing manual reconciliation across inconsistent formats

- Custom KPI and reporting gaps: Xero’s native reports miss critical ecommerce metrics like channel profitability and SKU-level margins

- Recurring report generation: Stakeholders wait for manual exports while finance teams spend hours on repetitive formatting

- Reconciliation headaches: Payout timing mismatches and refunds create endless manual adjustments

But what makes ecommerce reporting in Xero so much harder than for other businesses?

Why ecommerce makes Xero reporting harder

Ecommerce introduces reporting complexity that traditional businesses never face.

Marketplace payout lags create timing mismatches

Amazon settlements arrive two weeks after orders ship, bundling hundreds of transactions with fees already deducted. Shopify consolidates daily sales into weekly payouts. eBay and Etsy follow their own settlement schedules.

This timing mismatch means your profit and loss statement shows sales from two weeks ago mixed with yesterday's refunds and deposits that have not arrived yet.

Without accounting automation to match individual orders to payouts in real time, your cash flow forecasting is guesswork. You know money is coming, but you cannot predict when or how much because settlements are disconnected.

Refunds and inventory adjustments require transaction-level detail

A single Amazon return affects five different accounts in Xero: revenue, sales tax, marketplace fees, inventory, and cost of goods sold. Recording this correctly requires creating a credit memo, adjusting inventory counts, reversing the fee allocation, and updating tax liability.

Manual journal entries for these adjustments consume hours each week and introduce errors, especially when SKU names do not match between channels and Xero.

Multiply this across dozens of returns per week, and you spend entire days fixing transactions that should have been posted correctly the first time.

Multi-channel data fragmentation blocks consolidation

Each sales channel structures data differently. Shopify separates shipping fees from product revenue.

Amazon bundles all fees into settlement reports. Payment processors like Stripe and PayPal deduct fees at different points in the transaction flow. POS systems use different tax calculation methods than online stores.

Finance teams end up exporting data from each platform into spreadsheets, manually mapping fields, reformatting columns, and hoping the totals reconcile. As order volume grows past 100 transactions per day, this process collapses under its own complexity.

Real-time connectors like Webgility handle multi-channel complexity at the source.

Businesses using multichannel ecommerce accounting in Webgility save up to 90% of time on reconciliation by eliminating the manual workflows that create reporting bottlenecks. The system handles order-level sync, fee mapping, and payout reconciliation across all channels, so your Xero reports stay accurate.

Let us break down how each bottleneck plays out and how automation solves it.

Scenario 1: Fixing month-end close delays with automated ecommerce data sync

Manual data entry and delayed settlements stall month-end close. Xero automation keeps reports up to date in real time, slashing close time.

The typical month-end scramble is familiar to most ecommerce finance teams. Downloading settlement reports from Amazon, parsing fee breakdowns, manually allocating charges, switching to Shopify to export orders, and entering them individually.

Each step introduces delays and errors. Manual entry alone can push close back by days or weeks.

PartyMachines experienced this firsthand. Their founder used to spend two to three weeks each month entering data into QuickBooks. After automating order, fee, and settlement sync, the team now saves 8 to 16 hours every week. This freed up time for strategic work and improved visibility into channel and SKU-level performance.

Automation posts orders, fees, and settlements instantly as transactions occur. When an order ships on Amazon, the system records the sale, captures associated fees, and updates inventory in Xero automatically.

When Shopify processes a refund, the credit appears in accounting immediately, matched to the original transaction. This eliminates the lag that causes timing mismatches and ensures financial records always reflect current business activity.

Once your data flows into Xero automatically, consolidation across multiple channels becomes the next challenge.

Scenario 2: Consolidating multi-entity and multichannel data for accurate group reporting

Automated multi-entity and multichannel sync delivers accurate, group-level reporting without copy-paste or data gaps.

Consolidation becomes exponentially harder as businesses expand across channels, regions, and legal entities. Different payout cycles, inconsistent SKUs, and manual exports create a fragmented view of financial performance.

Without ecommerce accounting automation, finance teams spend hours downloading data from each platform, normalizing formats, and compiling reports that should provide unified visibility.

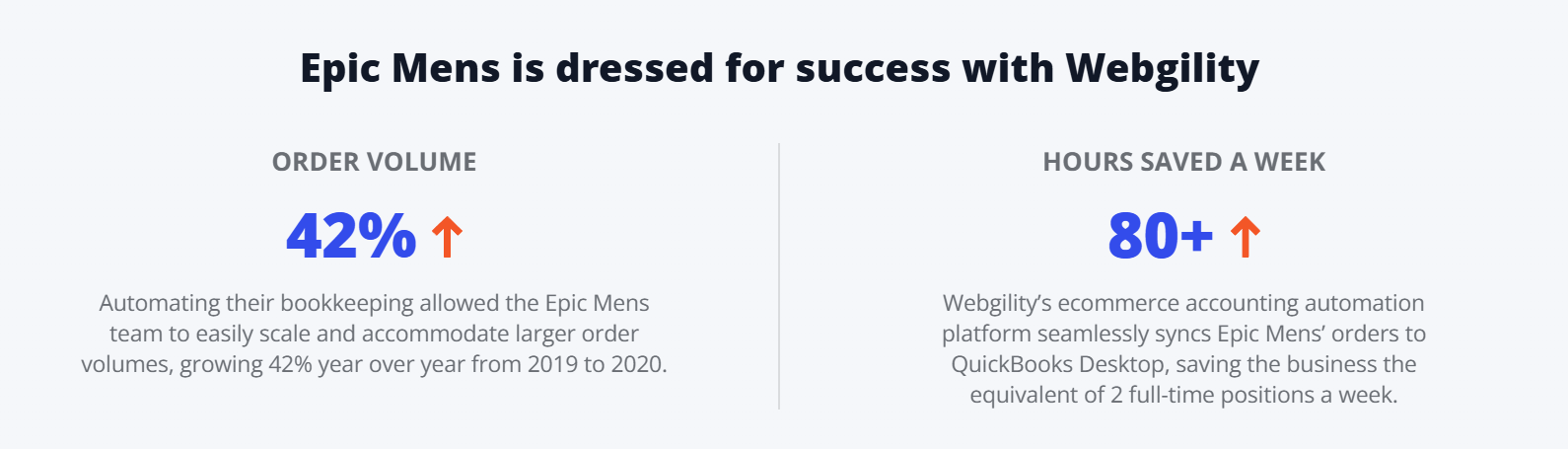

Epic Mens customer success story

Epic Mens provides a clear example. Their team of four processes 6,000 to 15,000 orders per month across Shopify and Amazon. Before automation, keeping the storefront and back office in sync was difficult.

After implementing automated multi-store sync, they achieved seamless syncing of sales records and inventory data between the storefront and accounting software. Order volume increased by 42%, and the team saved over 80 hours per week without adding headcount.

Shen Li, the owner, shares: “[Our] initial focus was around the orders, but a lot of things happen to inventory outside of orders. Things get lost. They get damaged. You have to set up new products. The benefits of having our inventory data so tightly coupled between the front office and the back office are probably as valuable as getting orders into systems in the first place.”

Webgility’s multi-store, multi-account sync and real-time inventory updates power accurate group reporting.

Clean, consolidated data unlocks the next step: actionable, ecommerce-specific KPIs.

Suggested read: Why Accountants Should Leverage Ecommerce Automation

Scenario 3: Turn Xero data into channel-specific profit metrics

Automated, granular data flows unlock channel, SKU, and fee-level profitability insights that Xero’s native reports cannot deliver.

Ecommerce businesses need visibility into metrics that generic accounting reports do not surface. Key ecommerce KPIs include:

- Channel profitability (after platform fees and fulfillment costs)

- SKU-level margins

- Fee-adjusted revenue

- Inventory turnover by location

- Abandoned cart recovery rates

Xero’s native reports often miss these insights because they lack fee and refund details, and do not split data by channel. Custom reporting requires exporting data to spreadsheets and building pivot tables. This is a process that quickly becomes outdated.

Skinny Mixes demonstrates the impact of detailed data. After automating bookkeeping and inventory management, they doubled order volume, improved marketing ROI, and added $3M in revenue. The team recovered 19% of abandoned carts and gained time to plan marketing strategies more effectively.

Webgility syncs detailed order, fee, and inventory data to enable advanced reporting that Xero alone cannot provide.

Once your KPIs are automated, the next step is to ensure that every stakeholder receives the right report on time.

Scenario 4: Automating recurring reports and stakeholder delivery

Automated scheduling and delivery of recurring reports ensures every stakeholder gets timely, accurate insights without manual effort.

Finance teams spend hours each week compiling reports for different audiences: weekly channel performance for marketing, monthly P&L for the CFO, and inventory snapshots for operations. Each report requires pulling data from Xero, formatting it, and distributing it.

When this process repeats every week or month, the time investment becomes substantial. To automate recurring report delivery:

- Choose the reports each team needs

- Set the schedule for delivery (weekly, monthly, etc.)

- Assign recipients for each report

- Test delivery to ensure accuracy and timing

Even with automated reporting, reconciliation remains a major pain point for ecommerce teams.

Scenario 5: Reconciling Xero with marketplaces and payment providers

Automated, transaction-level sync prevents reconciliation errors, flags exceptions, and makes audits and month-end close far smoother.

Common reconciliation failures include payout timing mismatches, refunds outside the accounting period, and inventory not reflected in COGS. Manual reconciliation is slow and error-prone, especially when marketplaces transfer net payouts rather than gross sales.

Webgility’s payout and settlement reconciliation, exception handling, and error flagging save up to 90% of reconciliation time.

Let us see how a real-time connector like Webgility addresses all five bottlenecks in one platform.

Suggested read: 5 Best Ecommerce Payment Reconciliation Software in 2025

How Webgility helps: The real-time connector for Xero and ecommerce

Webgility delivers real-time, order-level sync, multi-channel support, and analytics. This solves every major Xero reporting bottleneck for ecommerce.

Here is how each scenario is solved by a specific Webgility module:

|

Bottleneck |

Webgility Solution Module |

Outcome |

|

Month-end close delays |

Order, fee, and payout sync |

Books close 3x faster |

|

Multi-entity/multichannel consolidation |

Multi-store, multi-account sync |

Unified, accurate group reporting |

|

Custom KPI/reporting gaps |

Analytics and custom dashboards |

Channel and SKU-level profitability |

|

Recurring report generation |

Automation and scheduling |

Timely, automate |

Table 1: How Webgility helps

Compared to A2X and manual processes, Webgility covers more channels, syncs in real time, and reduces error risk.

Your 30-day implementation roadmap

Automation is the foundation for fast, accurate, and actionable Xero reporting. By connecting your ecommerce channels to Xero with a real-time connector, you eliminate manual work and unlock insights that drive growth.

Here is a simple 30-day roadmap to get started:

- Audit your current data flows and reporting gaps

- Choose automation for order and fee sync

- Set up multi-channel consolidation and inventory sync

- Automate recurring reports for every stakeholder

- Monitor reconciliation and iterate as your business grows

See how Webgility can transform your Xero reporting. Start a free Webgility trial today.

Frequently asked questions (FAQs)

How does automation handle Amazon’s payout delays?

Automation matches each Amazon order to its payout, even when settlements arrive weeks later, ensuring accurate, real-time revenue and fee tracking.

Can Shopify refunds be automated in Xero?

Yes, with the right connector, Shopify refunds are synced and matched to the original order in Xero, updating revenue, fees, and inventory automatically.

What if I add a new ecommerce channel?

Most automation tools support dozens of ecommerce, marketplace, and POS integrations. Adding a new channel is as simple as connecting your account and mapping fields.

Is my financial data secure with automation?

Reputable automation platforms like Webgility use bank-grade encryption and strict security protocols to protect your financial data.

David Seth is an Accountant Consultant at Webgility. He is passionate about empowering business owners through his accounting and QuickBooks Online expertise. His vision to transform accountants and bookkeepers into Holistic Accountants continues to grow.

-1.webp)