.png)

How to Connect Square and Xero: Integration Methods Compared

Contents

TLDR

Your Square POS processes $50,000 in sales monthly. You manually export transaction reports, then spend hours entering sales, fees, and taxes into Xero. By the time you finish, the data is outdated, and reconciliation reveals errors that force you to start over.

The Xero Square integration eliminates manual data entry, but multiple connection methods exist with different capabilities and trade-offs. Choosing the wrong integration approach costs time and creates accuracy problems.

In this guide, you will compare Xero Square integration methods and choose the right approach for your business.

Why integrate Square with Xero: The real accounting challenge

Manual reconciliation between Square and Xero costs retailers many hours weekly and exposes them to costly errors.

For example, a specialty retailer with two locations may spend 12 hours weekly exporting Square reports and re-entering sales, refunds, and fees into Xero. This process leads to missed transactions, delayed month-end close, and zero visibility into true margins.

Core challenges that drain your time

- Manual entry of daily sales, refunds, and fees creates opportunities for error and compliance risk

- Inventory mismatches between POS systems and accounting make it impossible to know true stock levels, leading to overselling and lost revenue

- Delayed financial visibility prevents timely, data-driven decisions

- Complexity multiplies as you add channels like Shopify or Amazon, doubling the manual workload overnight

But not every integration path solves these problems equally well. Some common pitfalls can make things worse.

Suggested read: Xero vs Square: Choose the Right Tool!

Common pitfalls in Xero Square integration

Native Square-Xero connectors often miss refunds, fees, or multi-location inventory, leading to incomplete books. The direct integration between Square and Xero promises simplicity, but merchants often discover critical gaps that create new problems.

The top 5 integration failures to avoid

- Incomplete data sync: Refunds, tips, and Square fees do not map to Xero at the transaction level, leaving vague summary entries

- Batch vs. real-time delays: Transactions appear in Xero days later, making daily reconciliation impossible

- No multi-location support: Direct connectors cannot track inventory separately for multiple stores

- Limited automation: Manual verification, exception handling, and adjustments are still required

- Poor troubleshooting support: Sparse documentation leaves you solving sync problems alone

For example, a growing retailer discovers that Square’s native integration does not track refunds at the transaction level. Every month, they manually adjust books for partial refunds the connector missed, adding hours to close and risking audit exposure.

Now let us compare the main integration methods and see which fits your business best.

Comparing Xero Square integration methods: Direct, third-party, and multichannel platforms

The right Square and Xero integration depends on your channels, volume, and growth plans. Direct connectors are fast but limited. Third-party apps add features at higher complexity. Multichannel platforms like Webgility future-proof your accounting as you scale.

Before choosing, consider these criteria: setup time, cost, automation depth, inventory sync, multi-location support, channel coverage, and support model.

|

Feature |

Direct Square-Xero |

Amaka |

Synder |

Bookkeep |

Webgility |

|

Setup time |

15 minutes |

30 minutes |

30-45 minutes |

30-45 minutes |

20-30 minutes |

|

Cost (monthly) |

Free |

Free-$49 |

$65-$150 |

$39-$99 |

Starts at $24 |

|

Automation depth |

Daily summary |

Daily invoice + fees |

Transaction-level |

Transaction-level |

Order-level, real-time |

|

Inventory sync |

None |

None |

Limited |

None |

Real-time |

|

Multi-location support |

Limited |

Yes |

Limited |

Limited |

Yes |

|

Channel coverage |

Square only |

Square only |

Payment processors |

Square, Shopify, Amazon |

20+ channels |

|

Support model |

Basic docs |

Live chat/email |

Live chat/email |

|

Dedicated onboarding/support |

Table 1: Xero Square integration methods compared

Direct Square-Xero is ideal for single-location, Square-only retailers who need a quick, no-cost sync of daily sales summaries. It is fast to set up but lacks transaction detail, inventory sync, and robust multi-location support.

Amaka offers more detailed daily invoices and better refund handling, making it a good fit for Square-focused businesses that want cleaner reporting and may add a second location.

Synder and Bookkeep suit businesses using multiple payment processors or needing transaction-level detail. They add complexity and cost but support more granular accounting.

Webgility is designed for multichannel sellers adding platforms like Shopify or Amazon. It provides real-time, order-level sync, multi-location inventory, and analytics across 20+ channels.

Now, let us map these options to your specific business scenario.

Choosing the right Xero Square integration for your business

Single-channel POS retailers need different tools than fast-growing omnichannel brands. Use this framework to match your needs:

1. Single-location Square POS

- Pain points: Manual entry, basic reporting, limited growth

- Best fit: Direct Square-Xero or Amaka

- Why: Fast setup, no extra cost, sufficient for simple operations

2. Ecommerce-only (Shopify, WooCommerce)

- Pain points: Multiple payment processors, need for transaction-level detail

- Best fit: Synder or Bookkeep

- Why: Supports Stripe, PayPal, and Square; provides detailed sync

3. Multi-channel (Square + Shopify + Amazon)

- Pain points: Inventory mismatches, reconciliation across channels, complex reporting

- Best fit: Webgility

- Why: Real-time, order-level sync across all channels, unified inventory and analytics

4. Scaling/adding new channels soon

- Pain points: Outgrowing basic connectors, manual work increasing

- Best fit: Amaka (short-term), Webgility (long-term)

- Why: Amaka bridges the gap, but Webgility eliminates the need for multiple connectors as you grow

If you operate across multiple channels, a unified platform like Webgility eliminates the need for multiple connectors and manual reconciliation.

Once you know your path, here is how to set up your integration step by step.

Setting up your Xero Square integration: Step-by-step

A successful setup starts with the right steps. Here is how to avoid common mistakes.

1. Direct Square-Xero setup

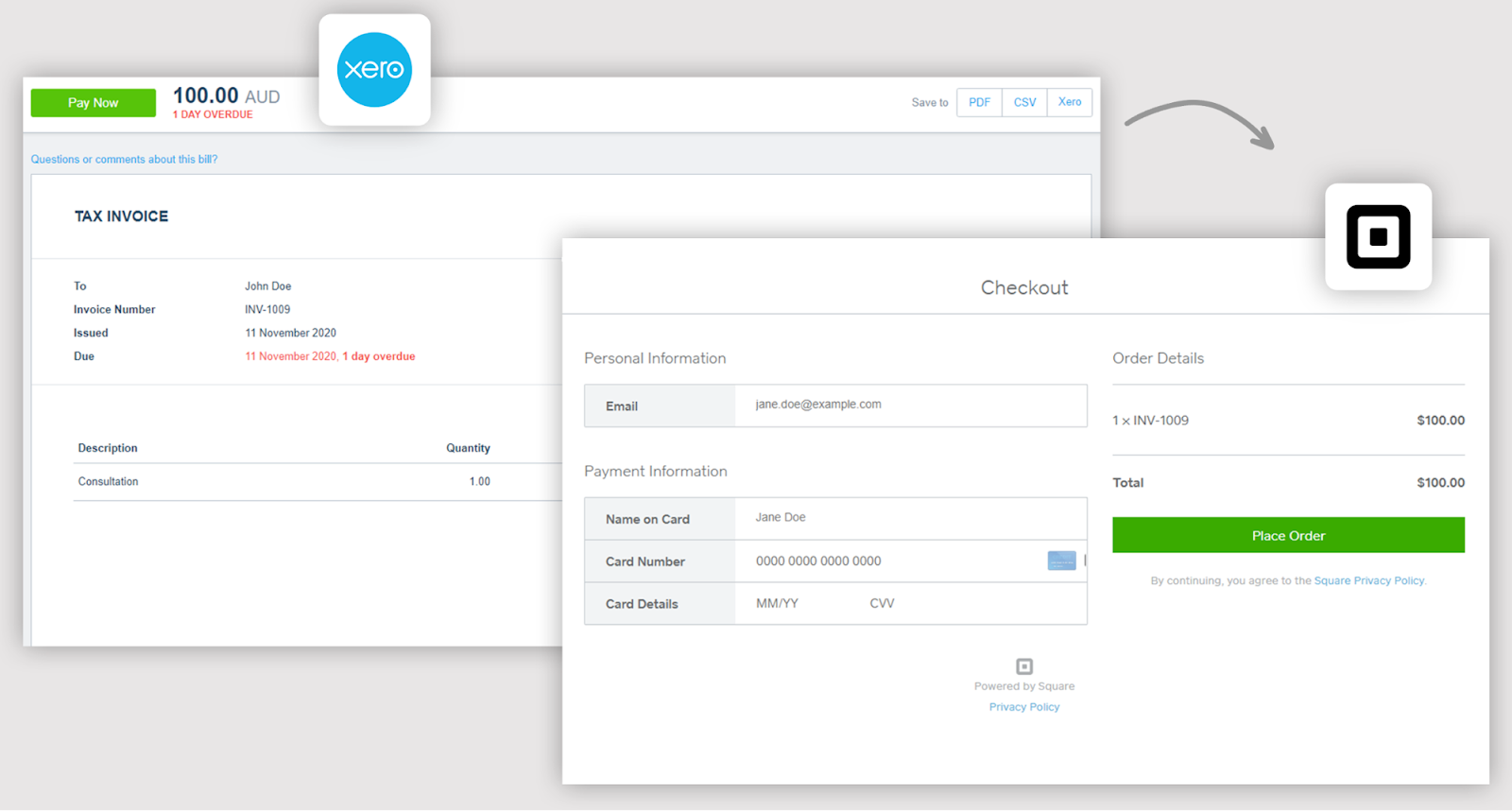

Xero Square integration enables seamless online invoice payments

- Go to the Square App Marketplace and select the Xero integration

- Connect your Square and Xero accounts

- Choose express or custom mapping for sales, fees, and taxes

- Schedule your daily sync

- Run a test transaction and verify it appears in Xero

- Review mapped accounts for accuracy

- Enable Xero automation

Estimated time: 15 minutes

2. Third-party app setup (Amaka, Synder, Bookkeep)

- Sign up for the app and connect your Square and Xero accounts

- Map sales, refunds, fees, and taxes to the correct Xero accounts

- Configure sync frequency (daily or real-time)

- Run a test sync and review results in Xero

- Adjust mapping as needed and enable automation

Estimated time: 20-45 minutes

Suggested read: Xero Tools for Small Businesses

3. Multichannel/Webgility setup

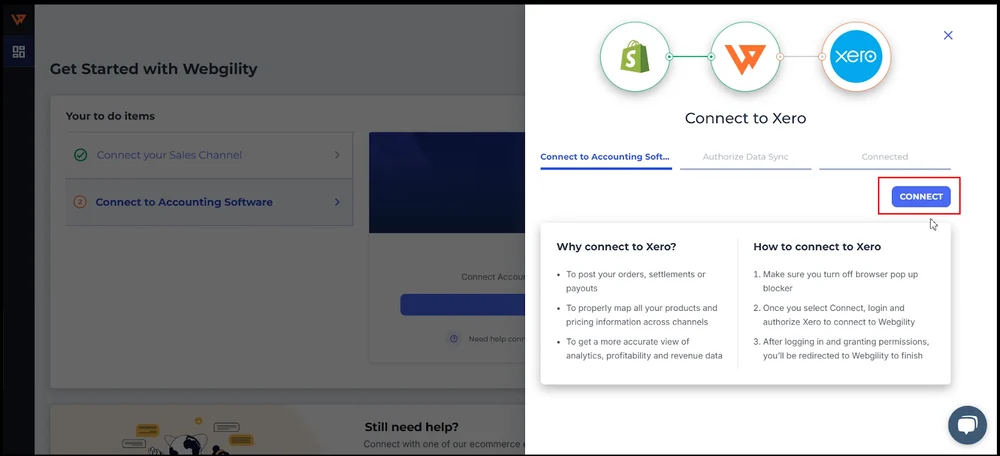

Connecting Xero to Webgility for automated accounting synchronization

- Sign up for Webgility and connect your Xero account

- Connect Square and any other sales channels (Shopify, Amazon, etc.)

- Map SKUs and configure sync rules for sales, refunds, and inventory

- Run a test order and verify order-level detail in Xero

- Enable real-time automation and inventory sync

- Schedule regular reconciliation reviews

Estimated time: 1-2 hours

Once set up, ongoing optimization keeps your integration running smoothly.

Maintaining and optimizing your Xero Square integration

To keep your integration healthy:

- Review reconciliation weekly to catch errors early

- Handle refunds, fees, and inventory adjustments promptly in both systems

- Monitor for sync errors and resolve them using support resources

- Update integration settings as you add channels or change products

Consider reviewing or upgrading your integration stack if you add a new channel, experience recurring accounting errors, or your inventory grows significantly. Community forums and help docs are valuable resources for troubleshooting and best practices.

Platforms like Webgility automate reconciliation and alert you to sync errors, saving up to 90% of manual accounting time.

But what if your business is outgrowing its current setup? Here is when to consider upgrading.

Scaling beyond Square: When to upgrade to a multichannel platform

Here are the signs you need more than direct Xero Square integration:

- Adding new sales channels like Shopify, Amazon, or Walmart

- Multi-location inventory headaches and overselling

- Margin reporting by channel or SKU is impossible

- Reconciliation takes more than 2 hours per week

Unified platforms for Xero accounting automation, like Webgility, add:

- Consolidated accounting across all channels

- Real-time inventory sync to prevent overselling

- SKU-level analytics for true margin visibility

Webgility connects Square POS with Shopify, Amazon, eBay, and other sales channels into a unified Xero accounting workflow. When you add ecommerce platforms to your existing retail operations, Webgility syncs orders, inventory, fees, and taxes from every channel automatically.

Rareform cut bookkeeping hours by 50% and saved thousands in accounting fees by automating their multi-channel operations with Webgility.

Ready to scale beyond Square and automate multi-channel accounting in Xero? Book a demo with Webgility today.

Frequently asked questions (FAQs)

Do I need a third-party app to connect Square and Xero?

Not always. Direct integration works for simple needs, but third-party apps or platforms like Webgility offer more automation, detail, and multi-channel support.

How do I keep inventory accurate across Square and Xero?

Choose an integration that supports real-time inventory sync, such as Webgility, to avoid mismatches and overselling.

What happens if I add new sales channels later?

You may need to upgrade to a multichannel integration platform to maintain unified accounting and reporting as you grow.

Can I switch from a basic connector to a multichannel platform later?

Yes, you can start with a simple integration and migrate to a more advanced solution like Webgility as your business expands.

Yvette Zhou is a Group Product Manager at Webgility, passionate about SaaS, fintech, and ecommerce innovation and product development.

.png?width=56&height=56&name=image%20(3).png) Yvette Zhou

Yvette Zhou.png)