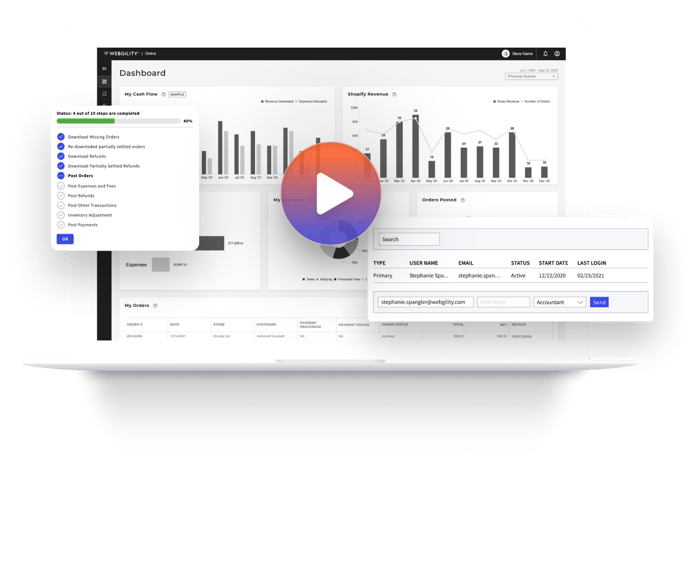

Connect your stores and QuickBooks

Webgility’s QuickBooks integration syncs order and expense data between your stores and QuickBooks automatically. Keep your books, prices, and even inventory counts up to date across your entire operation. You can even record sales tax, customer and item details, shipping and payment expenses, refunds, and marketplace fees.

Sync tax data seamlessly with accounting automation

Webgility pairs accounting automation with Avalara for sales tax management for QuickBooks Desktop customers. Instantly validate any local sales tax you’ve charged, organized by jurisdiction. Meanwhile, Webgility pulls in exact tax data for QuickBooks Online customers, regardless of where you sell. You can even route that data to a clearing account so that you can keep taxes segmented and organized.

Simplify the monthly closing process

Webgility’s accounting automation software captures marketplace fees, seller expenses, Amazon settlements, Shopify payouts, and more. Close your books with confidence, knowing your QuickBooks and bank statements match up.

Keep your accountant in the loop

Invite your accountant or bookkeeper to access your Webgility account, so they can track and adjust accounting automation workflows as needed. Accountants and bookkeepers can access additional functions and don't need a Webgility plan to do it.

The #1 app recommended by thousands of businesses and accountants

70% of Webgility customers save up to 10 hours per week on manual processes with real-time automation.*

Start a 15-day free trial. No credit card required.

*Based on a survey of 41 Webgility customers who were asked how many hours they have saved on manual processes or back-office operations since they started using Webgility. Data acquired in November 2023.