What Is Accounting Automation? 10 Common Questions Answered

Contents

Have you heard of accounting automation? As an ecommerce and small business leader or finance professional, it feels great to have all your organization’s accounting and sales data organized and in one place.

However, getting there can be time-consuming and come at an expensive opportunity cost. It’s time to think lean and strategically with the utilization of automation. Automation can bring simplicity and accuracy to otherwise painful tasks. Even better automation can give you time back to focus on strategy and growth.

1. What is accounting automation?

Accounting automation is the utilization of machine learning and other complex technologies to perform traditional accounting processes such as syncing transactions, sorting expenses, validating data, and balancing accounts. Accounting automation replaces repeatable and mundane tasks to allow accountants and finance officers to focus on planning and strategy.

What is ecommerce accounting automation?

Automating the accounting process is essential for any retail business to keep up in the quickly growing, technology-first marketplace. Ecommerce businesses, however, are uniquely positioned to reap the benefits of automation.

While a retail store may need to settle 10,000 transactions, ecommerce stores often have the same number of transactions from 10 revenue sources and customers in 10 different states.

This type of complex sales landscape crosses a variety of tax laws, fee structures, and reporting requirements that are tedious to process without help from technology. Automation reduces the risk of common accounting mistakes and saves time.

As ecommerce organizations grow, they can recycle that saved time to use for strategic decision-making like activity reports, shipping vendors, supplier negotiations, and product expansions.

2. What tasks can ecommerce accounting automation perform?

There are a multitude of ways to engage with accounting automation, depending on the business and its needs. Accounting automation software can help with most accounting needs, especially items such as data standardization, data processing, and data storage.

Here are a few examples of tasks that can be automated:

- Expense reporting

- Expense tracking

- Automatic invoicing

- Automatic payment processing

- Tracking and reporting daily/weekly/monthly sales

- Tracking on a sales channel level

- Managing product inventory changes

- Forecast fluctuating inventory levels

- Recording total purchases made by an individual customer

- Return tracking

- Calculating product’s sale value after fees

- Automatic supplier invoicing

- Calculating fees associated with the sale (marketing, shipping, merchant fees, etc.)

- Calculating and reporting tax information

- Creation of financial reports

- Sales tax by location

- Shipping and handling processing and recording of costs

3. Can accounting ever be fully automated?

The accounting industry is changing at an impressive rate thanks to automation software. Positions focusing on data collection or performing basic reporting and analysis are rapidly being replaced.

One recent study shows that over 80% of all tasks in accounts payable, accounts receivable, financial closing, controller work, financial planning, and tax preparation can currently be automated.

However, accounting extends further than bookkeeping and record consolidation. Accountants have the ability to understand and synthesize financial reports better than anyone else.

An accountant’s new role is to be a technical expert in accounting automation technologies and to use financial information to offer insights on risk management, financial policies, performance evaluation, and business strategy.

Sorry, Accountants, you still have work to do.

4. Can accounting automation work for any ecommerce business?

Yes! Accounting automation can work for any industry and any type of organization.

The automation software market is plentiful with comprehensive solutions for nearly every accounting need. The trick is to uncover what form of automation your business can benefit from the most.

To do this you must examine what type of accounting processes your organization devotes the most time to and then find a program your team can leverage to automate those tasks.

Ecommerce organizations have a unique advantage in accounting automation as most of their accounting information is already in a digital format. This means that with proper configuration, data entry can be completely eliminated. Ecommerce businesses can put away the ledgers and Excel reports and start focusing on optimization.

Accounting automation is often more advantageous for ecommerce over other industries as ecommerce has more complexities involving multiple sales channels, variations in sales tax processing, and constantly changing fees.

Accounting automation systems have a higher value to more complex sales processes regardless of the industry, but especially in ecommerce.

Businesses that are just starting out or have low sales volume may consider holding off on paying for accounting automation software. We cover this in detail below.

5. How does ecommerce accounting compare to traditional accounting?

Time: Ecommerce accounting automation practices will save any organization hours. Instead of an employee manually scrubbing and standardizing invoices and reconciling bank statements, software like Webgility can integrate with multiple revenue streams and pull all your data into one place.

Instead of managers manually entering receipts to process P&L statements, a system like Ramp can scan your receipts and invoices and automatically build the needed report.

Accuracy: Many believe that automated accounting processes lead to more accurate accounting as there is less opportunity for human error. However, this is a hot debate. Some people believe the double-entry nature of a traditional debit and credit entry allows users to eliminate data entry errors.

Security: Both traditional and accounting automation processes have some level of security risk. A traditional accounting office must guard hard files and their local server the same way digital accounting software must be guarded.

The need to protect sensitive information transcends the traditional vs. automated divide, but cybersecurity is often simple, less expensive, and less time-consuming than physical security.

Cybersecurity tips that ensure accounting automation security:

- Keep software current and up to date.

- Create strong passwords by using upper and lower-case letters, numbers, and special characters.

- Back up your files regularly in an encrypted file or encrypted file storage device.

- Avoid working on public wifi.

- Limit access to sensitive information and software to a need-only basis.

- Share best security practices with your team and emphasize security importance.

Any type of automation adds a level of security risk. Accounting automation software is like any other technology and requires human collaboration and attention to remain secure. From password complexity to immediately implementing software updates, there are many opportunities to practice safe security protocols.

Expense: As a small business owner, adding yet another operating cost is never an easy decision. Still, in many cases, it’s the right decision, especially when it comes to accounting automation. You may add to your operational cost but save on opportunity costs.

With proper account automation, your financial team can build complex reports, dive into the most profitable channels, reduce input costs, and more. Instead of spending hours inputting data, processing payments, and building basic reports, they can transcend traditional accounting and work from a place of holistic financial knowledge that can build better strategies.

6. How does ecommerce accounting automation help small businesses?

There are three main ways that accounting automation helps small businesses.

- It can save time by reducing or eliminating inefficient manual processes.

- It can improve the efficiency and accuracy of data.

- It can provide business insights.

Ecommerce accounting automation adds a layer of efficiency to unavoidable processes such as calculating sales tax in multiple states, reconciling transactions from one or multiple sources, and managing inventory.

By reducing these manual, data migration-driven tasks business owners have time on to do other things important to growing their business. With more time, small businesses can expand marketing efforts, add new products or sales channels, and connect with their customers while knowing their accounting processes are managed.

Reconciling hundreds of transactions from multiple states is a hard task for anyone. When someone is responsible for manually sorting through thousands of data points, there are bound to be mistakes.

Unfortunately, a small accounting error could cost small businesses everything. A mistake could put a small business at risk, whether it is an overlooked refund glitch or forgotten sales tax information.

Running reports that once took hours can take a few minutes once all transaction, inventory, and expense data are standardized and in one place. Many ecommerce automation software options offer reports to predict cash flow and sales volume.

There are even reports that separate out sales channels and shipping fees. Small business leaders can leverage these reports to make better decisions for their customers and their business.

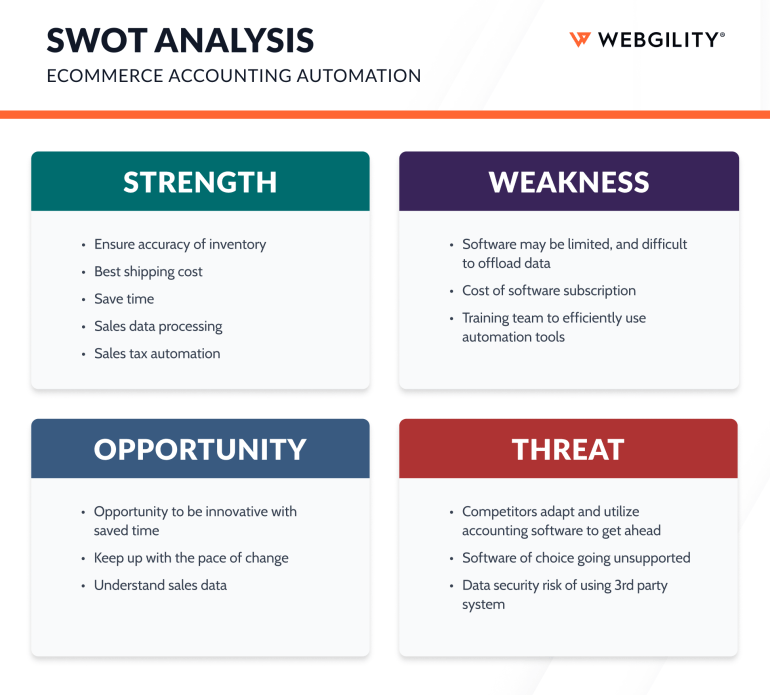

The opportunity cost of manual accounting can devastate a small business in a competitive market. If you are still not convinced, take a look at the SWOT Analysis below:

7. When should I start using ecommerce accounting automation?

An online business of any age and size could use accounting automation, but some will benefit much more than others. If you are only selling a few things a week in one store, automation may not be on the top of your list, which is OK.

Automation is important for ecommerce businesses that are processing hundreds or even thousands of transactions a week. Another example is online vendors who sell on multiple sales channels, such as Amazon, Walmart, Etsy, Shopify, eBay, and others will also see massive improvements with the installation of automated software. Rather than managing each channel individually, all channel sales data will be in one easily accessible place.

8. When should I start using ecommerce accounting automation?

An online business of any age and size could use accounting automation, but some will benefit much more than others. If you are only selling a few things a week in one store, automation may not be on the top of your list, which is OK.

Automation is important for ecommerce businesses that are processing hundreds or even thousands of transactions a week. Another example is online vendors who sell on through multiple sales channels, such as Amazon, Walmart, and Etsy will also see massive improvements with the installation of automated software. Rather than managing each channel individually, all channel sales data will be in one easily accessible place.

9. How do I choose an ecommerce accounting automation platform?

Evaluating ecommerce accounting platforms is probably the toughest part of automating your accounting processes. QuickBooks Online vs. Desktop, for example, is a common debate. Here are some questions to guide your research.

- Does the service integrate with your sales channel and accounting software?

- Does the service provide automation for the accounting processes you need?

- What is the cost structure of the software? And the estimated total cost?

- Does the software allow your business to scale?

- How long has the software been supported?

- Is the software likely to be properly maintained?

- Who sets up the software and integrates it with your current systems?

- Is there customer support?

- What do the reviews show?

- Is there a free trial or live demo? If so, try it!

The answers to these questions will help your team find the best software for your business. Remember that the software is only as good as its implementation, so be cautious and considerate of configuration requirements. Have an expert available to start your automation journey on the right path.

10. How long does accounting automation take to set up?

Automated accounting technology setup and configuration can take as little as a day. Automation software that offers white glove onboarding will often configure your system within a day and walk internal financial staff through their normal processes.

After the initial implementation is set up and users feel confident in day-to-day tasks, users generally start to leverage the software to generate unique and specific reports.

This learning curve and level of comfort with new software depend on individual users. Software with customer support can help empower users to try new things and utilize new accounting capabilities more quickly.

If the software does not come with an onboarding option or your business has chosen a DIY route, installation and configuration can take a bit longer. Software adjustments can likely be made quickly.

It will take your team time to learn the software’s capabilities and how to best leverage each feature to help your business succeed. Navigating new software is always tricky, so it is important to be resilient. Set up should not take more than one work week.

If you find that your team is struggling with setup, reach out to the software provider to ensure that your business can continue to move forward.

Regardless of the software your team chooses or the setup options, it is important that you allot yourself and your financial team time to learn the new system and its outputs.

Do not find yourself in a situation where your organization is paying for automation software and not utilizing its functions correctly. This can cost your organization the momentum you need to reach that next level and overshadow big wins.

Webgility accounting automation connects all your stores to your QuickBooks to save time and money

The Webgility Team

The Webgility Team