Credit Memo in QuickBooks: When to Use It vs. Refunds and Delayed Credits

Contents

TLDR

A customer returns a $500 order. You issue a refund through your payment processor, then open QuickBooks to record the transaction. Should you create a credit memo, process a refund, or use a delayed credit?

You pick one, close the books, and discover three months later that your accounts receivable is off by thousands because you recorded returns incorrectly all quarter.

QuickBooks offers three ways to handle returns and customer credits, but using the wrong one creates accounting chaos. Refunds, delayed credits, and credit memos in QuickBooks serve different purposes and affect your books differently.

In this guide, you will learn when to use each option and how to record returns correctly.

Your options: Credit memo, refund, and delayed credit in QuickBooks

Each QuickBooks credit tool handles customer credits differently, with distinct impacts on your accounting, customer communication, and cash flow.

Credit memo

It reduces a customer’s outstanding balance without moving cash. The credit sits on their account until applied to a future invoice. Use this for returns when customers want store credit instead of cash back.

Refund

This returns actual money to the customer through their original payment method.

Cash leaves your bank account immediately or within processing time. Use this when customers explicitly want their money back.

Delayed credit

This credit tool records a credit for future use with a specific date attached. The credit posts automatically on that date. Use this for promised adjustments or credits that should apply next month.

Here is how each credit type affects your key business metrics:

|

Credit Type |

Accounts Receivable Impact |

Customer Communication |

Cash Flow Impact |

|

Credit memo |

Reduces balance immediately |

Shows as available credit |

No immediate impact |

|

Refund |

Clears or reduces balance |

Money returned to payment method |

Cash leaves account |

|

Delayed credit |

No impact until posted |

Appears on future date |

No impact until posted |

Table 1: Credit tools in QuickBooks compared

Examples:

- If a customer returns a $200 item and wants store credit, issue a credit memo

- If a customer wants $200 back to their credit card, issue a refund

- If you promise a $200 credit on next month’s invoice, use a delayed credit

As order volumes grow, many ecommerce teams automate accounting and credit management to avoid manual errors.

Next, see why choosing the right tool matters for financial accuracy and customer trust.

Why your credit tool choice matters: Financial impact and customer experience

The wrong credit choice can break reconciliation, distort reports, and frustrate customers. Accuracy here saves hours and protects your brand.

When credit memos are created but never applied, credits sit unused on customer accounts for months. Your accounts receivable aging report looks wrong because of these orphaned credits. During audits, you are forced to manually hunt through records to clean up the mess.

The real cost of credit errors:

- Reconciliation time: Teams spend hours monthly fixing credit-related errors

- Customer confusion: Incorrect statements lead to support tickets and damaged trust

- Cash flow impact: Wrong credit types can unnecessarily reduce available cash

- Audit complications: Unapplied credits create discrepancies that auditors flag

Accounting automation platforms can prevent many of these issues by ensuring credits are posted correctly every time.

Let us break down when and why to use each tool, so you can avoid these pitfalls.

Suggested read: QuickBooks Online Inventory Tracking: Step by Step

Credit memo vs. refund vs. delayed credit: A practical comparison

Choosing the right tool depends on the situation. This table and examples make the decision obvious.

Here is a quick reference guide:

|

Scenario |

Use This Tool |

Impact on AR |

Cash Flow Effect |

Customer Experience |

Can It Be Automated? |

|

Customer returns item, wants store credit |

Credit memo |

Reduces balance |

No change |

Sees credit on account |

Yes, with Webgility |

|

Customer wants money back via original payment |

Refund |

Clears balance |

Cash leaves |

Receives refund in 3-5 days |

Yes, with Webgility |

|

Promised discount for next month |

Delayed credit |

No immediate impact |

No immediate impact |

Credit appears on schedule |

Yes, with Webgility |

|

Overpaid invoice correction |

Credit memo |

Reduces balance |

No change |

Immediate balance adjustment |

Yes, with Webgility |

Table 2: Credit memo vs. refund vs. delayed credit

Now, use this framework to choose the right tool every time.

Suggested read: Ways to Enhance QuickBooks for Ecommerce

Decision guide: How to choose the right credit tool in QuickBooks for every scenario

A clear framework means your team always knows which credit tool to use. Here is a step-by-step decision process:

- Did you already receive payment?

- If no, consider whether a credit is needed at all

- If yes, continue

- Does the customer want cash back or store credit?

- If cash back, use a refund

- If store credit, continue

- Should the credit apply now or on a future date?

- If now, use a credit memo

- If at a future date, use a delayed credit

- Is this a one-time or recurring adjustment?

- One-time: Credit memo or refund

- Recurring: Set up delayed credits or automation

- Can this be automated?

- If yes, set up rules in your accounting platform

Automation platforms like Webgility let you set custom rules so your team does not have to decide each time.

Once you know which tool to use, here is exactly how to do it in QuickBooks.

Suggested read: How Ecommerce Automation Saves Time and Reduces Errors in QuickBooks

Step-by-step instructions to create and apply credits in QuickBooks

Follow these steps to issue credits, refunds, or delayed credits in QuickBooks accurately.

How to create a credit memo in QuickBooks Online

Credit memo creation screen in QuickBooks Online

Credit memo creation screen in QuickBooks Online

- Select + New and choose Credit Memo

- Select the customer

- Enter the credit memo date

- Add line items for products or services being credited

- Save and close

|

Tip: Double-check the customer and amount before saving. Use a consistent date to match the original invoice. |

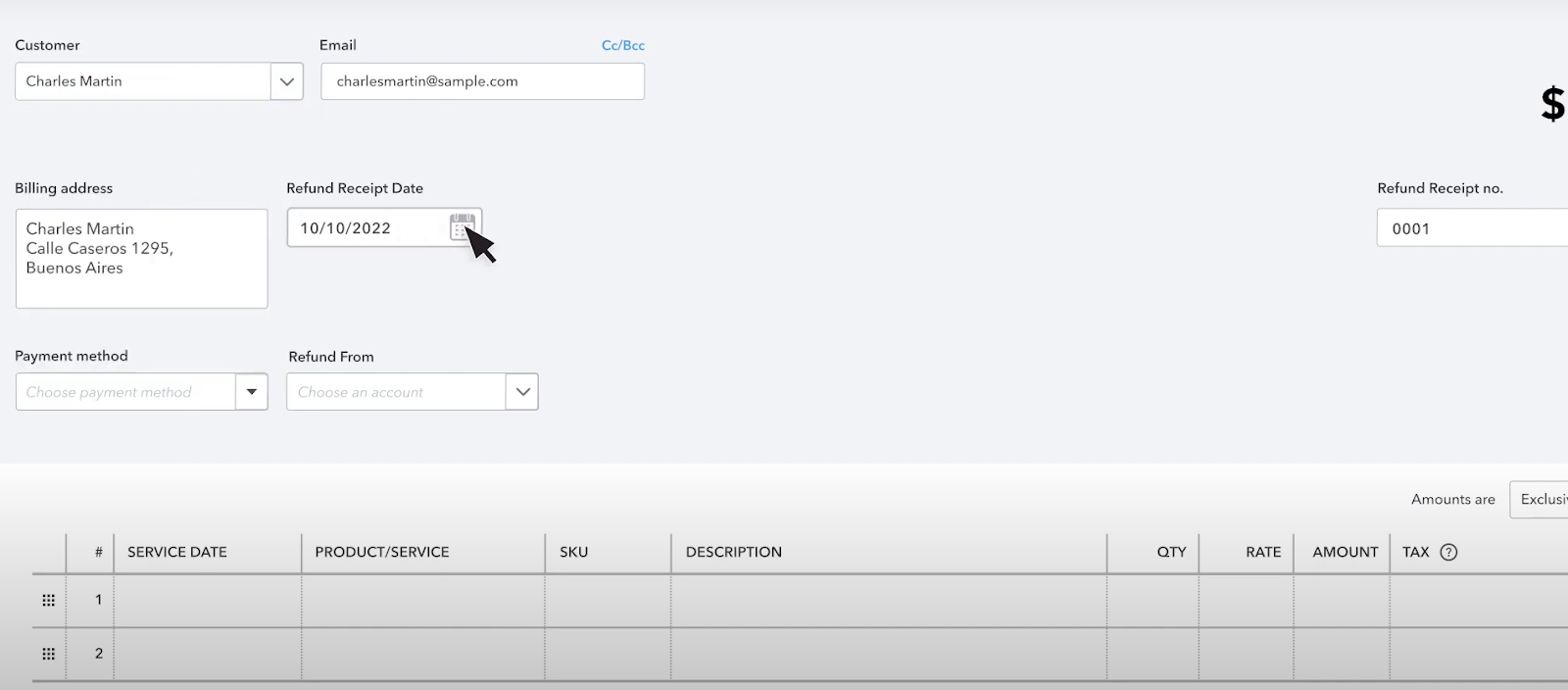

How to issue a refund in QuickBooks Online

- Select + New and choose Refund Receipt

- Select the customer and payment method

- Enter the refund amount and items

- Choose the bank or payment account for the refund

- Save and close

- Match the refund to your bank feed for clean, automated account reconciliation

Refund receipt screen in QuickBooks Online

Suggested read: Maximizing Efficiency in QuickBooks Enterprise for Ecommerce

How to create a delayed credit in QuickBooks Online

- Select + New and choose Delayed Credit

- Select the customer

- Enter the date the credit should apply

- Add line items and amounts

- Save and close

- When ready, apply the delayed credit to a future invoice

Delayed credit creation screen in QuickBooks Online

Delayed credit creation screen in QuickBooks Online

With Webgility, many of these steps can be automated, reducing manual entry and errors.

As credit volumes grow, manual steps become unsustainable. Here is how to scale your process.

Suggested read: Tax Mistakes that Annoy Your Accountant

Best practices for managing customer credits as you scale

Scaling credit management means moving from manual checks to automated, auditable workflows—saving time and reducing errors.

Sample workflow for a team handling 500+ credits per month:

- Manual: Download returns report, create credit memos one by one, apply credits manually, reconcile at month-end

- Automated (with Webgility): Sync returns from Shopify/Amazon, auto-create credit memos or refunds based on rules, auto-apply credits, and real-time reconciliation

Key metrics to track:

- Credit memo aging (how long credits sit unapplied)

- Refund ratio (refunds vs. credit memos issued)

- Error rate (manual corrections needed)

- Audit trail completeness

Channie saved 60+ hours per month by automating credit management with Webgility, reducing manual errors and improving audit readiness.

Webgility automates the entire returns and refunds workflow for multi-channel ecommerce businesses. When a customer initiates a return on Shopify, Amazon, or eBay, Webgility automatically creates the appropriate refund entry or credit memo in QuickBooks with complete order details, SKU information, and reason codes.

The platform tracks which returns require credit memos vs. immediate refunds based on your business rules, eliminating the guesswork that leads to accounting errors.

Ready to eliminate manual credit memo in QuickBooks entry and improve your returns accounting accuracy? Automate credit management across all your sales channels with Webgility. Book a demo today.

Frequently asked questions (FAQs)

What happens if I accidentally use the wrong credit tool in QuickBooks?

You can reverse the incorrect entry and reissue the credit using the correct method to keep your records accurate.

Can I automate credit memos and refunds in QuickBooks?

Yes, with platforms like Webgility, you can set rules to automate most credit and refund workflows.

How do I track unapplied credits in QuickBooks?

Run the Unapplied Credits report in QuickBooks and follow up monthly to ensure credits are properly applied.

Will delayed credits affect my financial reports immediately?

No, delayed credits do not impact your current period balances until the scheduled date when they are posted.

David Seth is an Accountant Consultant at Webgility. He is passionate about empowering business owners through his accounting and QuickBooks Online expertise. His vision to transform accountants and bookkeepers into Holistic Accountants continues to grow.

-1.webp)