Shopify Accounting: Best Practices That Simplify the Process

Contents

TLDR

Proper accounting is the foundation of any successful Shopify business, yet most merchants need help to get their books in order. Unfortunately, Shopify accounting can feel daunting, thanks to everything from inventory management to diverse payment methods and fulfillment challenges.

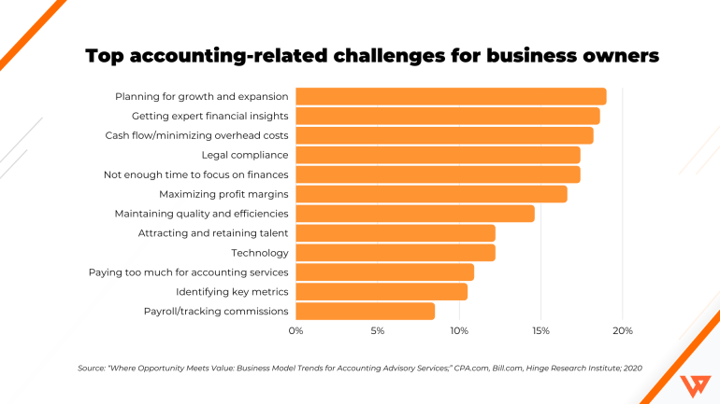

When it comes to ecommerce accounting, 19% of businesses said planning for growth and expansion was their top accounting challenge.

18.6% said getting expert financial insights was their top accounting challenge. And 18.2% said managing cash flow and reducing overhead costs was their top accounting challenge.

The good news is that doing Shopify accounting right can help you stay on top of your financial health, grow your business, and manage other top challenges.

So let’s explore what makes Shopify accounting challenging, Shopify accounting best practices that can simplify the process, and how automation can improve ecommerce accounting overall.

4 Common Shopify Accounting Challenges

1. Your business is always open

Traditional brick-and-mortar stores can learn a lot from ecommerce. But if there’s one thing physical stores have over online businesses, it’s the ability to put a “closed” sign on the door.

Ecommerce businesses are more 24/7 than nine-to-five. As a result, ecommerce merchants face constant inventory and fulfillment challenges. Staying on top of your operations requires accurate Shopify accounting.

2. Inventory management is more complex than it looks

Shopify merchants know the ecommerce inventory control hurdle all too well. Tracking the amount, location, and pricing of available inventory can be a real headache.

Accurate Shopify accounting can help you stay up to date and avoid overselling. But it also requires you to track and sync orders instantly.

3. You have to accept many payment methods

Not offering enough payment methods is among the reasons for increased cart abandonment rates. Many payment options can help meet customers’ needs, but they can make Shopify accounting much more difficult.

Meanwhile, merchants that use Shopify Payments, the platform’s built-in online payment provider, are subject to fees deducted from Shopify payouts. This deduction can make Shopify accounting difficult if you’re not tracking your sales, refunds, and fees separately.

4. Manual data entry is vulnerable to human error

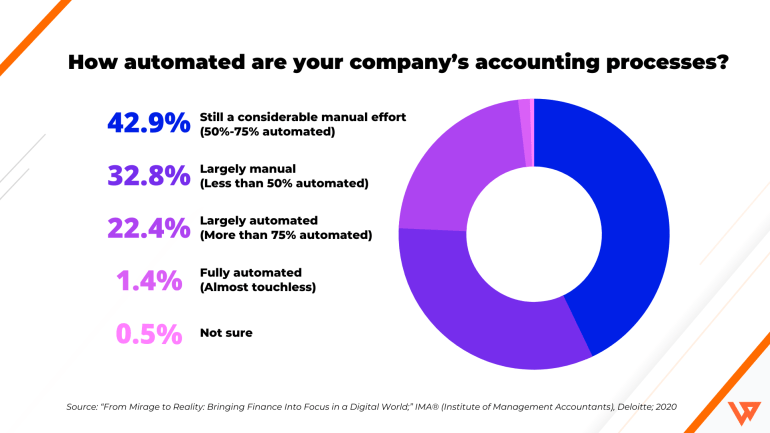

Almost a third of businesses surveyed in 2020 by the IMA® (Institute of Management Accountants) and Deloitte said their accounting processes are largely manual. Less than half of their accounting processes are automated.

Another 42% said their accounting processes are still a considerable manual effort. Manual data entry in Shopify accounting is time-consuming and can lead to human errors that have significant business consequences.

Best Practices for Shopify Accounting

Many small business owners look at Shopify accounting as unwanted homework. But the truth is that ecommerce accounting is the best way to understand your business performance and sets the foundation for growth.

Follow these best practices for simpler, more accurate Shopify accounting.

Shopify accounting best practice: Keep your books up to date

Precise accounting requires correct data, so keeping a close eye on your books — and closing your books frequently — is vital. The quality of the input determines the quality of the output.

The only way to plan, create forecasts, reduce the risk of cash flow issues, and prepare to file tax returns is to ensure your books are up to date.

Accounting software is the most efficient way to stay on top of your bookkeeping and organize invoices, cash accounts, and receipts.

Shopify accounting best practice: Keep track of your inventory

Inventory management is one of the most critical aspects of an ecommerce business. Without a clear picture of the goods you have in stock, you won’t be able to order, restock, store, and forecast your inventory levels to meet demand.

To meet customer demand and avoid stockouts, you need a multichannel inventory management solution that syncs inventory across channels and downloads the data to your accounting platform.

You can also manage pricing details and sync prices, quantities, or both from your accounting solution to Shopify.

Shopify accounting best practice: Use the accrual accounting method

There are two accounting methods: cash accounting and accrual accounting. Cash accounting recognizes revenue and expenses when you receive or pay cash.

Accrual accounting recognizes a transaction when you earn funds or incur expenses, regardless of when you receive cash or make a payment.

Accrual accounting gives more accurate insight into the health of your business and makes forecasting easier. And it can help you understand whether you’ll need funding to grow your business.

Shopify accounting best practice: Monitor costs and expenses

Expenses affect your bottom line. Inaccurate expense reports can lead to poor decisions around resource allocation.

Plus, inaccurate expense records will affect your tax filings and distort your financial health to creditors and investors. So create a standard monitoring procedure and track your expenses meticulously.

Shopify accounting best practice: Reconcile your accounts regularly

Reconciliation ensures that the money leaving an account matches the actual money spent at the end of a fiscal period. The reconciliation process allows you to check for errors or fraudulent activity so that nothing slips through the cracks.

The frequency of reconciliations depends on the nature of your business and average transaction volumes. Experts recommend reconciling your accounts at least once a month when you close your books so that you can spot any differences.

Shopify accounting best practice: Implement fraud prevention measures

Establish strong fraud controls and consider segregating duties, dual authorization for transactions, and proper documentation requirements.

Shopify Protect offers chargeback protection on fraudulent, eligible orders. But you should regularly review financial statements, run regular financial audits, and digitize your accounting processes to reduce the risk of fraud.

Shopify accounting best practice: Automate your Shopify accounting

Automation has significantly impacted how companies perform their ecommerce accounting by removing the least efficient aspects of an accountant’s work. The result is more time for analysis, strategy, and informed decision-making.

Accounting automation allows you to sync order info between your sales channels and accounting platform and even record sales tax, customer and item details, shipping and payment expenses, and marketplace fees.

Overall, accounting automation can save time, increase productivity, and produce more accurate data.

Shopify accounting best practice: Plan your taxes

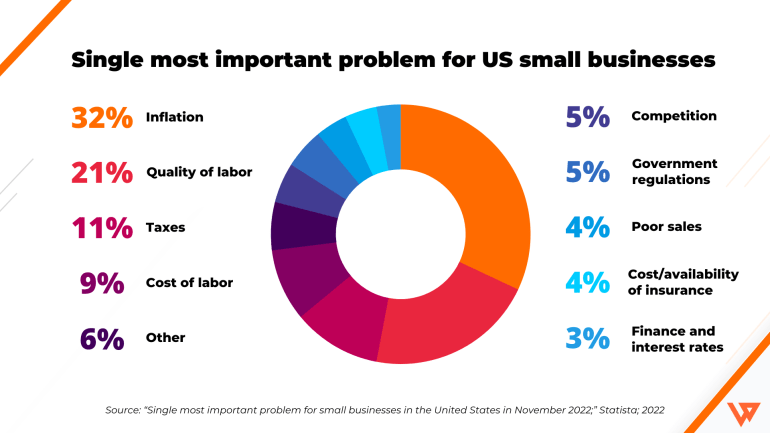

In November 2022, 11% of U.S. small businesses said taxes were their most important problem, making it the third most important problem overall. Failing to account for taxes is a common accounting mistake that can have severe consequences.

To best plan your taxes, ensure you have the right tools to charge and record tax information for each sale. Connecting an ecommerce automation tool with a tax calculator, for example, can ensure you’ve charged local sales taxes accurately.

Then you can record and sync any tax discrepancies from your online sales channels into your accounting platform so that everything is up to date.

Shopify accounting best practice: Get better Shopify performance insights

If you’re looking at Shopify accounting as something you must check off your to-do list, you’re wasting a huge opportunity to gather insights on the health of your business.

With ecommerce analytics, you can find the insights you need to make data-driven decisions, get high-level gross profit trends, and detailed metrics by channel and expense type.

How automation improves Shopify accounting and grows businesses

There’s no doubt that automation has revolutionized Shopify accounting. Here are a few examples of how Shopify merchants grew their businesses with automation by integrating Shopify and QuickBooks.

It can help you overcome operational headaches from manual bookkeeping

Skinny Mixes is the leading manufacturer of low-calorie cocktail mixes, sugar-free coffee syrups, and other specialty beverage items. The instant success of the products led to fast-paced growth that manual data entry couldn’t keep up with.

Syncing their Shopify and QuickBooks platforms let Skinny Mixes consolidate data and refocus on product innovation. With greater accuracy in accounting and inventory, the brand doubled its online business year over year.

Adopting automation helped the team reduce errors and refocus on their customers and operations, which increased order volumes 75%.

It can help you save time, reduce roadblocks, and increase efficiency

Rareform creates one-of-a-kind, repurposed bags and accessories from billboards in 350 retail stores and online. But the team needed help mapping sales data into Microsoft Excel and QuickBooks.

With ecommerce automation software, the Rareform team reduced the hours they spent on busywork. And multichannel order management allowed them to get timely information on inventory they needed to reorder.

It can help you sync online storefronts and back-end operations

Epic Mens sells a variety of brands hand-selected for superior design and quality. The brand wanted to scale its ecommerce efforts. But first, they needed to connect their online storefronts and back-end operations.

Automating their bookkeeping allowed Epic Mens to easily scale and accommodate larger order volumes, growing 42% yearly. Plus, ecommerce accounting automation helped them seamlessly sync orders to QuickBooks, saving 80 hours a week.

Webgility simplifies Shopify accounting through automation

Technology has greatly influenced the world and how people conduct business, and accounting is no exception. Ecommerce businesses have just started to scratch the surface using the power of accounting automation.

Webgility’s Shopify integration can connect your QuickBooks Online or Desktop account to your Shopify store to simplify operations overall. When you connect the two platforms, you won’t have to switch between your Shopify store and your QuickBooks file and manually enter information.

Post orders to QuickBooks as sales receipts, sales orders, invoices, or estimates easily. Avoid costly stockouts by syncing product prices and quantities between your Shopify store and QuickBooks. You’ll always know what you have and where it’s located.

With Webgility, you can view your Shopify store’s performance holistically. Get actionable insights on sales trends, top-selling products, and customer locations to keep close tabs on business performance in real time.

FAQs

How can small businesses ensure compliance with accounting regulations and laws?

The best way to ensure compliance is to document all transactions and regularly review your financial records. You may also want to hire a professional accountant who has expertise in accounting regulations and laws.

What are the best ways to prevent and detect fraud in accounting?

In order to prevent and detect fraud, you should frequently double-check financial records and ensure that no single person has total control of your business’s accounting. You may also want to hire an auditor. Auditors are accountants who specialize in detecting mistakes in financial records.

How can businesses effectively use technology to streamline accounting processes and improve efficiency?

Businesses can use popular accounting software like QuickBooks and Xero to improve efficiency and speed up the accounting process. If you are running an ecommerce business, Shopify has an article with tips to improve ecommerce accounting.

Reference: https://www.shopify.com/in/blog/accounting-best-practices

How often should I reconcile my Shopify transactions with QuickBooks in 2026?

You should reconcile your Shopify transactions at least once a month — but high-volume stores benefit from weekly or even daily auto-reconciliation. Tools like Webgility for QuickBooks can sync and reconcile payouts automatically, helping you catch discrepancies faster and keep your financial data accurate.

Can Shopify automatically handle taxes and compliance for my ecommerce business?

Yes. Shopify Tax, launched in 2023 and expanded in 2026, automatically calculates and applies local, state, and regional tax rates across the U.S., Canada, and the EU. For complete compliance and reporting, integrate Shopify Tax with accounting platforms like QuickBooks or automation tools like Webgility.

What are the biggest Shopify accounting mistakes to avoid in 2026?

The most common accounting mistakes include mixing personal and business expenses, not automating reconciliation, ignoring COGS updates, and misreporting sales tax. Using automated ecommerce accounting software ensures all transactions, fees, and taxes are accurately recorded.

How can AI help with Shopify accounting and bookkeeping?

In 2026, AI-driven tools can automatically categorize expenses, flag duplicate transactions, and predict cash flow issues before they occur. Webgility’s automation platform uses AI to sync Shopify and QuickBooks data in real time, ensuring error-free financial management and faster month-end closing.

Webgility can help you automate and simplify Shopify accounting

Yvette Zhou is a Group Product Manager at Webgility, passionate about SaaS, fintech, and ecommerce innovation and product development.

.png?width=56&height=56&name=image%20(3).png) Yvette Zhou

Yvette Zhou