The Solopreneur’s Guide to Ending Manual Accounting Systems

Contents

|

Key Takeaways:

|

If you’re a solopreneur, you know the drill: double-checking receipts, late nights with spreadsheets, and still wondering if your books are right. Manual accounting might feel “good enough” for now, but it’s quietly eating hours, creating errors, and holding back your growth.

But, you don’t have to keep doing it this way. Once you know how to move from manual chaos to simple, automated bookkeeping that actually works, you’ll get real-time visibility and audit-ready books hassle-free.

In this blog, we’ll show you the reality of manual accounting systems and why it's time to switch to automation. By the end of the read, you can identify warning signs of implementing seamless automation with the industry-leading tool like Webgility.

Without further ado, let’s get started!

The hidden costs & risks of manual accounting systems

Manual accounting systems It's easy to think spreadsheets are saving you money – after all, they're free. But that's an illusion. The real cost of manual accounting isn’t in software fees; it’s in the lost time, costly mistakes, and missed opportunities that silently drain your business.

Here’s a breakdown of the hidden costs you're actually paying.

- Time sink: The hours spent on manual data entry, reconciling bank statements, and correcting inevitable errors add up fast. This is time you could be spending on revenue-generating activities like marketing, product development, or talking to customers. This isn't just administrative work; it's a direct opportunity cost

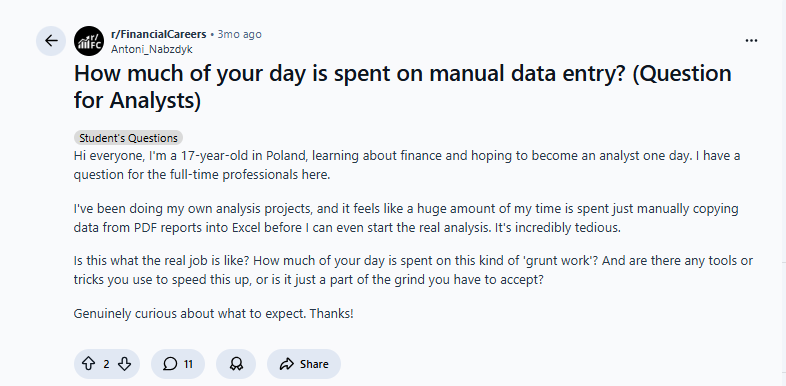

A Reddit user shows his frustration by asking this question (check screenshot below):

- Human errors & misclassifications: A simple typo can throw off your entire balance sheet. Manually categorizing expenses often leads to misclassifications, which can result in inaccurate financial reports and, worse, overpaying or underpaying on your taxes

- Poor scalability as business grows: As your business grows, so does transaction volume. Manual systems can’t keep up, making it difficult to manage multiple income streams, contractors, or vendors

- Difficulty in generating detailed insights or actionable reports: Without automation, reports are often outdated by the time you generate them. You lose the ability to make data-driven decisions when you need them most

- Storage, backup, and security risks: Spreadsheets are vulnerable to file corruption, loss, or unauthorized access. Cloud-based accounting software, by contrast, ensures secure data storage and automatic backups

- Lost opportunities: Critical business questions like "Should I hire a contractor?" or "Is this client profitable?" require immediate answers. The answers to them require real-time, reliable data. Manual systems force delays in answering these critical questions, so you let profitable opportunities slip away

Bonus read: Manual Accounting Slowing You Down? 5 Signs It’s Time to Automate

Manual vs automated accounting: What sets them apart

Understanding the difference between manual accounting systems and modern automated solutions reveals exactly what you lose (or gain) when you stick with manual accounting systems.

| Aspect | Manual Accounting (The Old Way) | Automated Accounting (The Smart Way) |

| Data entry | Hours of tedious typing. You manually enter every sale, fee, tax, and expense from receipts, bank statements, and e-commerce reports. | Zero manual entry. Data syncs automatically. Every order detail flows directly from your sales channels (like Shopify or Amazon) into your books. |

| Accuracy & reliability | Constantly at risk. A single typo or miscategorized expense can throw off your entire financial picture, leading to flawed reports and tax headaches. | Precise and consistent. AI-powered rules categorize transactions correctly every time. Your books are accurate, reliable, and always audit-ready. |

| Speed & efficiency | Constantly at risk. A single typo or miscategorized expense can throw off your entire financial picture, leading to flawed reports and tax headaches. | Precise and consistent. AI-powered rules categorize transactions correctly every time. Your books are accurate, reliable, and always audit-ready. |

| Speed & efficiency | Painfully slow. Closing your books can take days or even weeks. You're always playing catch-up with old data. | Happens in real-time. Reconciliation is instant and continuous. You can close your books for the month in just a few clicks. |

| Business insights | Flying blind. Generating a report is a major task, so you make critical decisions based on outdated information or gut feelings. | An intelligent dashboard. Get instant, real-time reports on profitability, sales trends, and cash flow. Make data-driven decisions with confidence. |

| Scalability | Growth is a problem. More sales mean exponentially more data entry. Your success creates an administrative bottleneck that suffocates your time. | Grow with you. The system handles 10 orders or 10,000 with the same minimal effort. Your accounting scales effortlessly as your business expands. |

| Accessibility & security | Tied to one device. Spreadsheets can be easily lost, corrupted, or compromised, with no secure backup. | Anywhere, anytime access. Your data is securely stored in the cloud with automatic backups, protected by bank-level security. |

7 Signs you’ve outgrown manual accounting systems

How do you know when manual accounting systems are holding you back? If any of these red flags feel all too familiar, that means your business is ready for an upgrade:

- Your transaction volume is steadily increasing. The time you spend on bookkeeping is growing every month

- You frequently find mistakes or spend hours trying to reconcile your books with your bank statement

- You're planning to hire a contractor or virtual assistant. You need a reliable, professional system to manage payments and expenses

- You lack timely cash flow visibility, profitability metrics, or financial reports that support quick, strategic pivots.

- You feel immense stress and panic during tax season, scrambling to pull everything together at the last minute – organize receipts, rebuild ledgers, and reconcile

- You’re tired of repeating the same entry tasks, which take you farther from growth work

You delay hiring a high-margin client or launching a new product because “books aren’t ready.

If any of these sound familiar, it’s time to explore an automated system like Webgility, built specifically to streamline bookkeeping for solopreneurs.

Your checklist for the right automation tool

As a solopreneur, you can't afford a tool that's built for large teams or one that doesn't understand your business. You need a system that acts like a smart, efficient partner.

When transitioning away from manual accounting systems, here are the features that truly matter:

1. Connect directly to where you sell

This is the most important feature, especially for ecommerce. A generic accounting tool that only syncs with your bank account is not enough. You need software that integrates seamlessly with your sales channels like Shopify, Amazon, Etsy, or eBay. It should automatically pull in every crucial detail:

- Individual orders and products sold

- Platform fees and transaction costs

- Sales tax collected

- Shipping charges and customer details

Why Webgility wins?

Webgility directly connects your ecommerce store (like Shopify or Amazon) and marketplaces (like Amazon or eBay) to your accounting software (QuickBooks or Xero). It syncs every single order detail, starting from products, fees, refunds, and taxes, so you never have to enter sales data manually again.

Opting for these ecommerce accounting automation software will help eliminate the primary source of manual data entry and ensure your revenue is recorded accurately down to the penny.

2. Automate the real bookkeeping work

Once the sales data is in, the software's job is to make sense of it all. The right tool will automatically categorize your expenses from linked bank accounts, learning your spending habits over time. It should make reconciling your books a one-click process, not a weekend-long project. You're looking for true automation, not just a fancier spreadsheet.

Why Webgility wins?

Webgility automates this by posting detailed transaction data directly to your chart of accounts in QuickBooks or Xero. It maps sales, fees, and expenses to the right categories, turning a multi-hour reconciliation chore into a simple, one-click confirmation.

3. Provide a clear, real-time dashboard

You need to know your numbers. A top-tier tool gives you an instant, visual snapshot of your business's health. Forget waiting to run reports. You should be able to see your cash flow, true profitability, and best-selling products at a glance. This is how you move from guessing to making confident, data-driven decisions.

Why Webgility wins?

Webgility’s dashboard gives you a real-time command center for your e-commerce business. See your store’s profitability, top-selling products, and channel performance instantly, so you can make data-driven decisions on the fly without waiting for month-end reports.

4. Make tax prep simple

Let's be honest, this is a huge reason to automate. Your software should make tax prep effortless. Look for features that organize your expenses, track potential deductions, and generate the tax-ready reports your accountant needs. The goal is to have clean, audit-proof books year-round, ending the last-minute panic for good.

Why Webgility wins?

Webgility ensures your books are tax-ready year-round. Accurately recording sales tax from every channel and itemizing all platform fees provides clean, detailed records. This ends the last-minute scramble and gives you (or your accountant) audit-proof reports.

5. Easy to use

As a solopreneur, you are the CEO, the marketer, and the bookkeeper. You don't have time for a tool with a massive learning curve. The software should be intuitive, straightforward, and have a mobile app that lets you manage things on the go like snapping a picture of a receipt or checking your daily sales from your phone. If it’s not simple, you won’t use it.

Why Webgility wins?

Webgility is built for a "set it and forget it" approach. After a simple setup, the automation runs in the background. The interface is designed for business owners, not accountants, and its mobile app lets you check your key sales metrics from anywhere.

Bonus read: 8 Best Accounting Software for Ecommerce in 2025

Simple steps to efficient bookkeeping as a solopreneur

Transitioning away from manual accounting systems is a process, but it's one that pays for itself almost immediately in time saved and stress reduced. Follow these steps to build a streamlined, professional bookkeeping workflow:

Step 1: Get your finances in order

Before you can build something new, you have to clean up the current mess. Gather all business-related financial documents for the current fiscal year: bank/credit card statements, digital and paper receipts, outstanding invoices, and cash transaction records.

Digitize everything (scan paper receipts) and create a simple digital filing system, like a main folder for the year with subfolders for each month. The goal is to get everything into one digital folder. Think of it as getting all your ingredients ready before you start cooking.

Step 2: Build your automation toolkit

You don't need a single, complicated piece of software. You just need two smart tools that work together.

1. The financial hub (Accounting software): Choose a cloud-based accounting platform like QuickBooks or Xero. This will be the central "brain" for all your financial data.

2. The ecommerce connector (Automation tool): This is the non-negotiable part. Your accounting software doesn't know how to talk to your e-commerce store on its own. A tool like Webgility is the essential bridge that connects your sales channels (Shopify, Amazon, etc.) directly to your accounting software, creating a seamless, two-way flow of information that ends manual entry for good.

Step 3: Activate your new workflow (Track & reconcile)

Let the system do the work. Your job is no longer to do the work, but to simply review it.

1. For expenses: Connect your business bank account to your accounting software. The bank feed automatically imports all your expenses. Your job is reduced to a quick weekly review to categorize them (e.g., "Software Subscription," "Office Supplies").

2. For income: Instead of manually entering sales, Webgility does it for you. It automatically syncs every single order from platforms like Shopify, Amazon, Etsy, and more. This tool doesn't just record the total sale amount; it breaks down every transaction into granular detail: the products sold, revenue, sales tax collected, marketplace fees, payment processing fees, and shipping costs. This is a level of detail that is impossible to maintain with a manual accounting system.

3. For reconciliation: Your accounting software shows your bank deposits on one side and your income on the other. Because Webgility has already posted detailed, accurate sales data, the lump-sum deposit from Shopify Payments or Amazon will perfectly match the batch of sales it represents. Your reconciliation process becomes a simple click to confirm, turning a multi-hour headache into a 10-minute monthly check-up.

Step 4: Start acting like a CEO, not a bookkeeper

With your finances on autopilot, your role completely changes. You can stop managing data and start using it to make smarter decisions.

1. Make tax time stress-free: Don’t wait until tax season to get organized. By maintaining up-to-date records, you can easily identify deductible expenses, calculate estimated quarterly payments, and generate tax-ready reports. Using Webgility, you can even capture sales tax details automatically, so filing returns is straightforward.

2. Answer critical business questions: "Garbage in, garbage out" no longer applies. When Webgility feeds clean, detailed, and accurate sales data into your accounting software, your reports become powerful strategic tools, so you can finally unlock true insights and answer:

- "What is my true profit margin on Amazon vs. my Shopify channel?"

- "How much did I really spend on payment processing fees?"

- "Is my cash flow healthy enough to invest in that new campaign?"

3. Use your accountant as an advisor, not a fixer: With manual accounting systems, an accountant reactively cleans up a year's worth of messy spreadsheets and receipts just to file taxes. They are fixing past problems at a high cost.

With an automated system, your accountant designs your financial foundation. For a few hours, they can perfectly configure your accounting software and tools like Webgility, ensuring every sale, fee, and tax is mapped correctly from day one.

How BeeCure gained back 40 hours a month with Webgility?

Company: BeeCure (Skincare / Health & Beauty)

The challenge:

The BeeCure founder, Diana Sabacinski, spent nearly a full week each month just reconciling orders and manually entering data into QuickBooks. Every sale from Amazon and Shopify had to be downloaded, double-checked, and posted by hand. The process was time-consuming, error-prone, and kept her from focusing on product growth and marketing.

The solution:

By switching to Webgility, BeeCure connected Shopify and Amazon directly to QuickBooks. Every order, fee, and tax detail now syncs automatically. That means - no more spreadsheets, no more manual uploads. Webgility’s onboarding team walked Diana through setup, ensuring the transition was seamless.

The results:

- 40 hours saved every month; bookkeeping that once took a week now takes just 1–2 hours

- Accurate, real-time financials across Amazon, Shopify, and QuickBooks

- White-lglove onboarding and responsive support made adoption effortless

- Renewed focus on growth by letting Diana focus more on marketing, customers, and scaling the business

In Diana’s Words:

“The best advice I can give is: everything always takes longer and costs more money than you expect. Webgility is not very expensive and it saves me so much time.”

The takeaway:

With Webgility automating her ecommerce accounting, Diana transformed bookkeeping from a week-long chore into a simple, one-hour check-in – freeing her to focus on what really matters: growing BeeCure.

Ready to trade your spreadsheet for 40+ hours a month?

If you’ve read this far, you know your manual accounting system isn't "free." It's costing you time, accuracy and opportunities. Every minute you spend updating spreadsheets, fixing errors, or reconciling deposits time you could be investing in growing your business.

As a solopreneur, your most valuable asset is your time. You deserve tools that deliver real-time insights, audit-ready books, and effortless accuracy. Moving to an automated system is the smartest step you can take to reclaim your time and step fully into your CEO role.

Step into a smarter way to manage your books with Webgility!

With Webgility, your bookkeeping runs on autopilot. Every order, fee, discount, refund and tax syncs seamlessly from all your sales channels straight into your accounting software; that means no manual work, no missed details.

Book a demo today and discover how Webgility can help you close your books in minutes, not days.

FAQs

What is a manual accounting system?

A manual accounting system is a method of bookkeeping that relies on physical records or basic spreadsheets to record financial transactions. Every entry, calculation, and report is created by hand without the help of specialized accounting software and automation tools.

What are the four types of accounting systems?

The main types include manual, computerized, cloud-based accounting systems, and ERP (Enterprise Resource Planning).

When thinking about accounting software, which automation tool comes to mind first?

For solopreneurs and multichannel sellers, Webgility stands out as a trusted accounting automation platform that integrates with QuickBooks, Xero, and NetSuite with popular marketplaces like Amazon.

Yash Bodane is a Senior Product & Content Manager at Webgility, combining product execution and content strategy to help ecommerce teams scale with agility and clarity.

.png?width=56&height=56&name=image%20(1).png) Yash Bodane

Yash Bodane